Form 1065me/1120s-Me - Maine Information Return Partnerships/llcs/s Corporations - 2006

ADVERTISEMENT

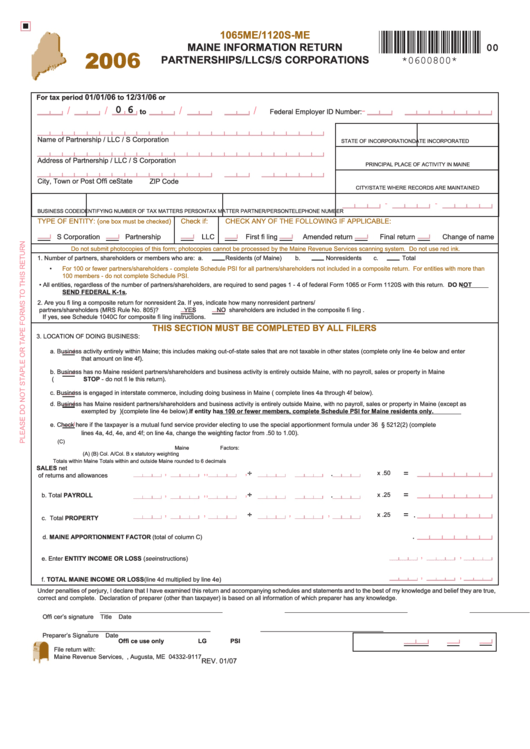

1065ME/1120S-ME

MAINE INFORMATION RETURN

00

2006

PARTNERSHIPS/LLCS/S CORPORATIONS

*0600800*

01/01/06

12/31/06

For tax period

to

or

0 6

-

/

/

/

/

to

Federal Employer ID Number:

Name of Partnership / LLC / S Corporation

STATE OF INCORPORATION

DATE INCORPORATED

Address of Partnership / LLC / S Corporation

PRINCIPAL PLACE OF ACTIVITY IN MAINE

City, Town or Post Offi ce

State

ZIP Code

CITY/STATE WHERE RECORDS ARE MAINTAINED

-

-

BUSINESS CODE

IDENTIFYING NUMBER OF TAX MATTERS PERSON

TAX MATTER PARTNER/PERSON

TELEPHONE NUMBER

TYPE OF ENTITY: (

)

Check if:

CHECK ANY OF THE FOLLOWING IF APPLICABLE:

one box must be checked

S Corporation

Partnership

LLC

First fi ling

Amended return

Final return

Change of name

Do not submit photocopies of this form; photocopies cannot be processed by the Maine Revenue Services scanning system. Do not use red ink

.

1.

Number of partners, shareholders or members who are: a.

Residents (of Maine)

b.

Nonresidents

c.

Total

•

For 100 or fewer partners/shareholders - complete Schedule PSI for all partners/shareholders not included in a composite return. For entities with more than

100 members - do not complete Schedule PSI.

•

All entities, regardless of the number of partners/shareholders, are required to send pages 1 - 4 of federal Form 1065 or Form 1120S with this return. DO NOT

SEND FEDERAL K-1s.

2.

Are you fi ling a composite return for nonresident

2a. If yes, indicate how many nonresident partners/

partners/shareholders (MRS Rule No. 805)?

YES

NO

shareholders are included in the composite fi ling .......... _________________

If yes, see Schedule 1040C for composite fi ling instructions.

THIS SECTION MUST BE COMPLETED BY ALL FILERS

3.

LOCATION OF DOING BUSINESS:

a.

Business activity entirely within Maine; this includes making out-of-state sales that are not taxable in other states (complete only line 4e below and enter

that amount on line 4f).

b.

Business has no Maine resident partners/shareholders and business activity is entirely outside Maine, with no payroll, sales or property in Maine

(STOP - do not fi le this return).

c.

Business is engaged in interstate commerce, including doing business in Maine ( complete lines 4a through 4f below).

d.

Business has Maine resident partners/shareholders and business activity is entirely outside Maine, with no payroll, sales or property in Maine (except as

exempted by P.L. 86-272)(complete line 4e below). If entity has 100 or fewer members, complete Schedule PSI for Maine residents only.

e.

Check here if the taxpayer is a mutual fund service provider electing to use the special apportionment formula under 36 M.R.S.A. § 5212(2) (complete

lines 4a, 4d, 4e, and 4f; on line 4a, change the weighting factor from .50 to 1.00).

(C)

Maine Factors:

(A)

(B)

Col. A/Col. B x statutory weighting

Totals within Maine

Totals within and outside Maine

rounded to 6 decimals

4.a. Totals SALES net

,

,

,

,

.

÷

=

x .50

of returns and allowances

,

,

,

,

.

÷

=

x .25

b. Total PAYROLL

,

,

,

,

.

÷

=

x .25

c. Total PROPERTY

.

d. MAINE APPORTIONMENT FACTOR (total of column C) ...................................................................................................................4d.

,

,

e. Enter ENTITY INCOME OR LOSS (see instructions) .......................................................................................................... 4e.

,

,

f. TOTAL MAINE INCOME OR LOSS (line 4d multiplied by line 4e) ....................................................................................... 4f.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements and to the best of my knowledge and belief they are true,

correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

____________________________________

____________________________________

___________________________

Offi cer’s signature

Title

Date

____________________________________

____________________________________

Preparer’s Signature

Date

Offi ce use only

LG

PSI

File return with:

Maine Revenue Services, P.O. Box 9117, Augusta, ME 04332-9117

REV. 01/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2