Tangible Property Form - Burrillville Page 2

ADVERTISEMENT

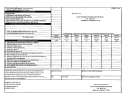

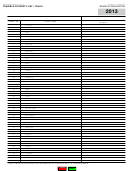

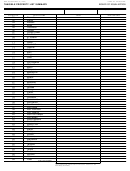

Please complete the itemized list of all Furniture, Fixtures, and Equipment (Including signs and unregistered motor vehicles)

owned by you or your firm on the next page, and report the total of each class by year of acquisition in the appropriate box

below. IMPORTANT - Be sure to declare all acquisitions still in use, even though fully depreciated on your books. All equipment

that you rent, lease or consign is to be listed only on the last page of this form in the appropriate section.

Manufacturers: Please include all assets NOT used directly in the actual manufacturing process.

Leasing Companies: Please provide disposition list indicating if the equipment was sold to lessee, returned, or other.

CLASS I - SUMMARY OF SHORT LIFE EQUIPMENT (ONLY AS DEFINED BY RIGL § 44-5-12.1)

All PC computers, peripherals and computer software should be reported in this category

Please summarize all Class I assets by year in this section. Only assets listed as Class I in the above statute are to be listed in this section.

Assessor’s Use Only

Calendar Year Purchased

Acquisition Cost

Depreciation Rate

Declared Value

2015

5%

2014

20%

2013

40%

2012

70%

2011 & Prior

80%

TOTALS

CLASS II –SUMMARY OF MID-LIFE EQUIPMENT

Please summarize all Class II assets by year in this section.

Please include items such as all typical furniture, fixtures, equipment as well as any item not listed as Class I or Class III in the above statute.

Assessor’s Use Only

Calendar Year Purchased

Acquisition Cost

Depreciation Rate

Declared Value

2015

5%

2014

10%

2013

20%

2012

30%

2011

40%

2010

50%

2009

60%

2008 & prior

70%

TOTALS

CLASS III - LONG LIFE ASSETS

Please summarize all Class III assets by year in this section.

Assessor’s Use Only

Calendar Year Purchased

Acquisition Cost

Depreciation Rate

Declared Value

2015

5%

2014

10%

2013

15%

2012

20%

2011

25%

2010

30%

2009

35%

2008

40%

2007

45%

2006

50%

2005

55%

2004

60%

2003

65%

2002 & Prior

70%

TOTALS

Inventory -

Note: Inventory for sale (wholesale or retail) or Manufacturing Raw Materials is not to be reported here.

Average amount of inventory (all goods, wares, supplies and

merchandise) kept on hand and used in the operation of your business

Sub Total Class I, II, III and Inventory

$

The information on this form is confidential. It is only available to assessment personnel and is not subject to public inspection.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4