Declaration Of Documentary Transfer Tax

ADVERTISEMENT

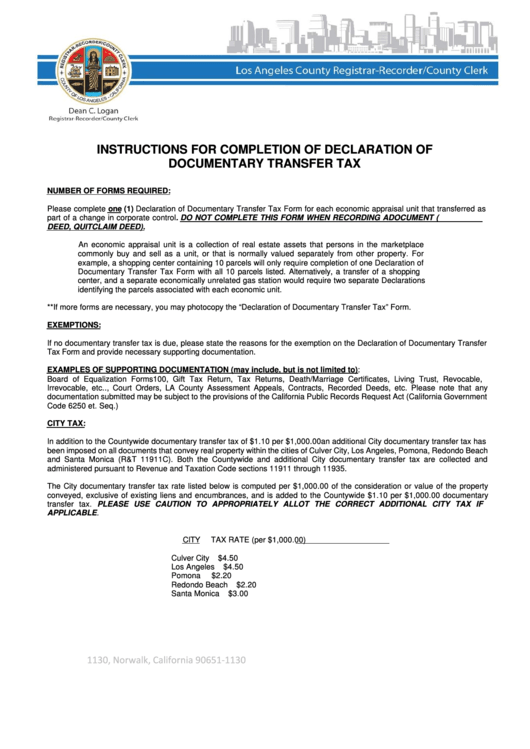

INSTRUCTIONS FOR COMPLETION OF DECLARATION OF

DOCUMENTARY TRANSFER TAX

NUMBER OF FORMS REQUIRED:

Please complete one (1) Declaration of Documentary Transfer Tax Form for each economic appraisal unit that transferred as

part of a change in corporate control. DO NOT COMPLETE THIS FORM WHEN RECORDING A DOCUMENT (I.E. GRANT

DEED, QUITCLAIM DEED).

An economic appraisal unit is a collection of real estate assets that persons in the marketplace

commonly buy and sell as a unit, or that is normally valued separately from other property. For

example, a shopping center containing 10 parcels will only require completion of one Declaration of

Documentary Transfer Tax Form with all 10 parcels listed. Alternatively, a transfer of a shopping

center, and a separate economically unrelated gas station would require two separate Declarations

identifying the parcels associated with each economic unit.

**If more forms are necessary, you may photocopy the “Declaration of Documentary Transfer Tax” Form.

EXEMPTIONS:

If no documentary transfer tax is due, please state the reasons for the exemption on the Declaration of Documentary Transfer

Tax Form and provide necessary supporting documentation.

EXAMPLES OF SUPPORTING DOCUMENTATION (may include, but is not limited to):

Board of Equalization Forms 100, Gift Tax Return, Tax Returns, Death/Marriage Certificates, Living Trust, Revocable,

Irrevocable, etc.., Court Orders, LA County Assessment Appeals, Contracts, Recorded Deeds, etc. Please note that any

documentation submitted may be subject to the provisions of the California Public Records Request Act (California Government

Code 6250 et. Seq.)

CITY TAX:

In addition to the Countywide documentary transfer tax of $1.10 per $1,000.00 an additional City documentary transfer tax has

been imposed on all documents that convey real property within the cities of Culver City, Los Angeles, Pomona, Redondo Beach

and Santa Monica (R&T 11911C). Both the Countywide and additional City documentary transfer tax are collected and

administered pursuant to Revenue and Taxation Code sections 11911 through 11935.

The City documentary transfer tax rate listed below is computed per $1,000.00 of the consideration or value of the property

conveyed, exclusive of existing liens and encumbrances, and is added to the Countywide $1.10 per $1,000.00 documentary

transfer tax. PLEASE USE CAUTION TO APPROPRIATELY ALLOT THE CORRECT ADDITIONAL CITY TAX IF

APPLICABLE.

CITY

TAX RATE (per $1,000.00)

Culver City

$4.50

Los Angeles

$4.50

Pomona

$2.20

Redondo Beach

$2.20

Santa Monica

$3.00

LAvote.net

LArecorder.net

P.O. Box 1130, Norwalk, California 90651-1130

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2