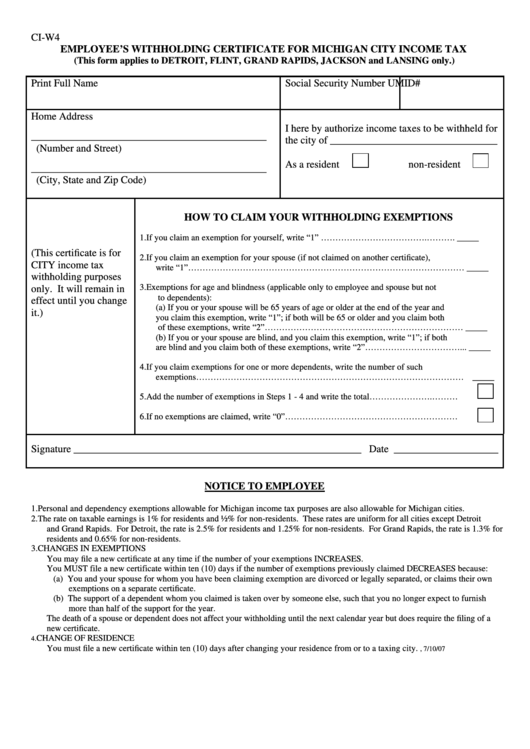

CI-W4

EMPLOYEE’S WITHHOLDING CERTIFICATE FOR MICHIGAN CITY INCOME TAX

(This form applies to DETROIT, FLINT, GRAND RAPIDS, JACKSON and LANSING only.)

Print Full Name

Social Security Number

UMID#

Home Address

I here by authorize income taxes to be withheld for

_____________________________________________

the city of ________________________________

(Number and Street)

As a resident

non-resident

_____________________________________________

(City, State and Zip Code)

HOW TO CLAIM YOUR WITHHOLDING EXEMPTIONS

1.

If you claim an exemption for yourself, write “1” ……………………………….……….

_____

(This certificate is for

2.

If you claim an exemption for your spouse (if not claimed on another certificate),

CITY income tax

write “1”…………………………………………………………………………………… _____

withholding purposes

3.

Exemptions for age and blindness (applicable only to employee and spouse but not

only. It will remain in

to dependents):

effect until you change

(a) If you or your spouse will be 65 years of age or older at the end of the year and

it.)

you claim this exemption, write “1”; if both will be 65 or older and you claim both

of these exemptions, write “2”……………………………………………………………

_____

(b) If you or your spouse are blind, and you claim this exemption, write “1”; if both

are blind and you claim both of these exemptions, write “2”……………………………... _____

4.

If you claim exemptions for one or more dependents, write the number of such

exemptions………………………………………………………………………………… _____

5.

Add the number of exemptions in Steps 1 - 4 and write the total………………….………

6.

If no exemptions are claimed, write “0”……………………………………………………

Signature _______________________________________________________ Date ____________________

NOTICE TO EMPLOYEE

1. Personal and dependency exemptions allowable for Michigan income tax purposes are also allowable for Michigan cities.

2. The rate on taxable earnings is 1% for residents and ½% for non-residents. These rates are uniform for all cities except Detroit

and Grand Rapids. For Detroit, the rate is 2.5% for residents and 1.25% for non-residents. For Grand Rapids, the rate is 1.3% for

residents and 0.65% for non-residents.

3. CHANGES IN EXEMPTIONS

You may file a new certificate at any time if the number of your exemptions INCREASES.

You MUST file a new certificate within ten (10) days if the number of exemptions previously claimed DECREASES because:

(a) You and your spouse for whom you have been claiming exemption are divorced or legally separated, or claims their own

exemptions on a separate certificate.

(b) The support of a dependent whom you claimed is taken over by someone else, such that you no longer expect to furnish

more than half of the support for the year.

The death of a spouse or dependent does not affect your withholding until the next calendar year but does require the filing of a

new certificate.

CHANGE OF RESIDENCE

4.

You must file a new certificate within ten (10) days after changing your residence from or to a taxing city.

CI-W4.doc, 7/10/07

1

1