Fair Market Value Form

ADVERTISEMENT

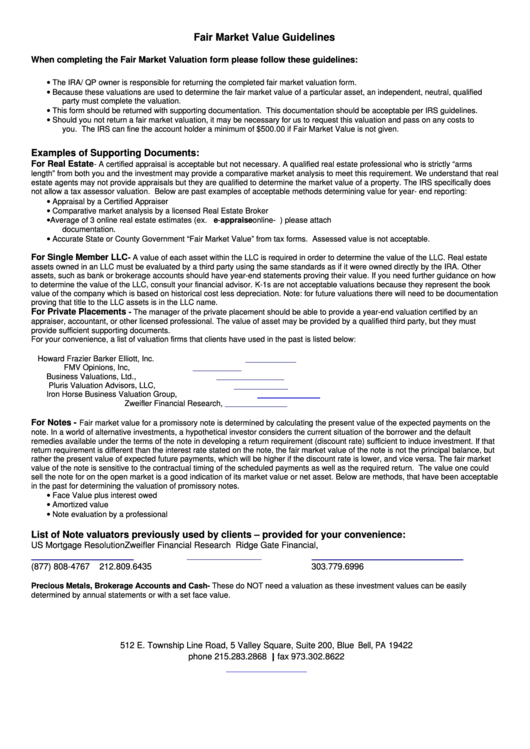

Fair Market Value Guidelines

When completing the Fair Market Valuation form please follow these guidelines:

The IRA/ QP owner is responsible for returning the completed fair market valuation form.

•

Because these valuations are used to determine the fair market value of a particular asset, an independent, neutral, qualified

•

party must complete the valuation.

This form should be returned with supporting documentation. This documentation should be acceptable per IRS guidelines.

•

Should you not return a fair market valuation, it may be necessary for us to request this valuation and pass on any costs to

•

you. The IRS can fine the account holder a minimum of $500.00 if Fair Market Value is not given.

Examples of Supporting Documents:

For Real Estate

- A certified appraisal is acceptable but not necessary. A qualified real estate professional who is strictly “arms

length” from both you and the investment may provide a comparative market analysis to meet this requirement. We understand that real

estate agents may not provide appraisals but they are qualified to determine the market value of a property. The IRS specifically does

not allow a tax assessor valuation. Below are past examples of acceptable methods determining value for year- end reporting:

Appraisal by a Certified Appraiser

•

Comparative market analysis by a licensed Real Estate Broker

•

Average of 3 online real estate estimates (ex. ) please attach

•

documentation.

Accurate State or County Government “Fair Market Value” from tax forms. Assessed value is not acceptable.

•

For Single Member LLC

- A value of each asset within the LLC is required in order to determine the value of the LLC. Real estate

assets owned in an LLC must be evaluated by a third party using the same standards as if it were owned directly by the IRA. Other

assets, such as bank or brokerage accounts should have year-end statements proving their value. If you need further guidance on how

to determine the value of the LLC, consult your financial advisor. K-1s are not acceptable valuations because they represent the book

value of the company which is based on historical cost less depreciation. Note: for future valuations there will need to be documentation

proving that title to the LLC assets is in the LLC name.

For Private Placements

- The manager of the private placement should be able to provide a year-end valuation certified by an

appraiser, accountant, or other licensed professional. The value of asset may be provided by a qualified third party, but they must

provide sufficient supporting documents.

For your convenience, a list of valuation firms that clients have used in the past is listed below:

Howard Frazier Barker Elliott, Inc.

FMV Opinions, Inc,

Business Valuations, Ltd.,

Pluris Valuation Advisors, LLC,

Iron Horse Business Valuation Group,

Zweifler Financial Research,

For Notes -

Fair market value for a promissory note is determined by calculating the present value of the expected payments on the

note. In a world of alternative investments, a hypothetical investor considers the current situation of the borrower and the default

remedies available under the terms of the note in developing a return requirement (discount rate) sufficient to induce investment. If that

return requirement is different than the interest rate stated on the note, the fair market value of the note is not the principal balance, but

rather the present value of expected future payments, which will be higher if the discount rate is lower, and vice versa. The fair market

value of the note is sensitive to the contractual timing of the scheduled payments as well as the required return. The value one could

sell the note for on the open market is a good indication of its market value or net asset. Below are methods, that have been acceptable

in the past for determining the valuation of promissory notes.

Face Value plus interest owed

•

Amortized value

•

Note evaluation by a professional

•

List of Note valuators previously used by clients – provided for your convenience:

US Mortgage Resolution

Zweifler Financial Research

Ridge Gate Financial,

(877) 808-4767

212.809.6435

303.779.6996

Precious Metals, Brokerage Accounts and Cash- These do NOT need a valuation as these investment values can be easily

determined by annual statements or with a set face value.

512 E. Township Line Road, 5 Valley Square, Suite 200, Blue Bell, PA 19422

phone 215.283.2868 | fax 973.302.8622

.com

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2