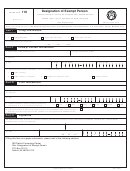

FinCEN Form 110

Designation of Exempt Person

General Information

6. Enter identifying numbers starting from left to right.

if you checked Item 1b to indicate that you are filing a

The Bank Secrecy Act and its implementing

Do not include spaces, dashes, or other punctuation.

biennial renewal (biennial renewals only required for

regulations require banks to file currency transaction

Identifying numbers include social security number

item 10e and 10f).

reports on transactions in currency of more than

(SSN), employer identification number (EIN), and

Part III Filer Information

$10,000. The regulations also permit a bank to ex-

individual taxpayer identification number (ITIN).

Item 12--Name of bank. Enter the bank’s full legal

empt certain customers from currency transaction re-

7. Enter all Post Office ZIP Codes from left to right

name.

with at least the first five numbers, or with all nine

Item 13, 14, 15 and 16--Address. Enter the bank’s

porting in accordance with 31 CFR 103.22.

(ZIP + 4) if known.

headquarters address.

Banks are the only type of financial institutions

that may exempt customers from CTR filing require-

8. Addresses: Enter the permanent street address,

Item 17--EIN. Enter the bank’s employer identifica-

ments. The term bank is defined in 31 CFR 103.11(c);

city, two-letter state or territory abbreviation used by

tion number (EIN).

and includes savings and loan associations, thrift in-

the U.S. Postal Service and ZIP Code (ZIP+4 if known)

Item 18--Primary regulator. Check only one of the

stitutions, and credit unions.

of the exempt person or entity. A post office box

following six boxes, OCC, FDIC, FRS, OTS, NCUA, or

number should not be used , unless no other address

The customers that the bank may exempt are

IRS.

is available. Also enter any apartment number, suite

Item 19--Affiliated banks. A parent bank holding

called “exempt persons”. An exempt person may be

number, or road or route number. If a P .O. Box is

company or one of its bank subsidiaries may make

a bank, government agency/government authority,

used for an entity, enter the street name, suite number,

the designation of exempt person on behalf of all bank

listed company, listed company subsidiary, eligible

and road or route number.

subsidiaries of the holding company so long as the

non-listed business, or payroll customer, as defined

designation lists each bank subsidiary that will treat

in 31 CFR 103.22.

Specific Instructions

the customer as an exempt person. If you are making

A bank may, but is not required to, use this form

such a designation, check the box in item 19. List the

to notify the Treasury that the bank has revoked the

Part I Filing Information

name and address of each bank subsidiary by com-

designation of a customer as an exempt person.

Item 1--Type of filing. Check only one of the four

pleting Part III of an additional Designation of Exempt

boxes. The bank will file an initial designation just once,

Person form for each bank subsidiary. Complete the

FinCEN encourages banks to use the exemp-

marking item 1a to signify the initial designation.

additional forms by entering the bank’s name and ad-

tion procedure to the fullest extent. FinCEN also re-

Additionally, with regard to non-listed businesses (item

dress in Items 12 through 18, and copy the informa-

minds banks of their continuing obligation to moni-

10e checked) or payroll customers (item 10f checked),

tion from Part IV, items 21 through 24 of your Desig-

tor for, and report suspicious activity with respect to

transactions of all customers, including currency trans-

the bank must file the form biennially to renew the

nation of Exempt Person form onto each additional

exempt status of these customers, marking item 1b to

form. Submit the additional forms by attaching them

actions conducted by exempt persons.

signify the biennial renewal. If amending a report (1c

to your Designation of Exempt Person form. The data-

checked) complete the amended report in its entirety.

base will accept up to a total of 20 entries.

When and where to file

Item 2--Effective date of the exemption. For initial

Any bank that wishes to designate a customer

designation, enter the date of the first transaction to

as an exempt person must file FinCEN Form 110,

Only one signature is required for this form

be exempted.

Designation of Exempt Person, with the IRS Detroit

-For biennial renewal, the effective date of the

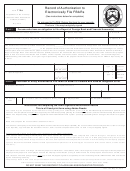

Part IV Signature

Computing Center no later than 30 days after the

exemption will be the same date the bank used in the

Item 20--Signature. An authorized official of the bank

first transaction to be exempted.

“effective date of the exemption box” when the initial

shall sign the form. (If item 1a, c, or d is checked)

The biennial renewal must be filed by March

designation was filed.

Item 21-- Print name. Enter the name of the bank

15 of the second calendar year following the year of

-For exemptions amended, if the effective date of the

official who signed the form.

the initial designation, and every other March 15

exemption is not being amended, the date entered

thereafter. If the bank missed filing the biennial

Item 22--Title. Enter the title of the bank official who

should be the same date the bank used in the “effective

signed the form.

renewal timely, contact DCC at 800-800-2877 for

date of the exemption box” when the initial

Item 23--Date of signature. Enter the current date

instructions.

designation was made; or if the effective date of the

the form was signed.

exemption is being amended, enter the date of the

Item 24--Telephone number. Enter the phone number

Send your completed form to:

first transaction to be exempted.

of the bank official who signed the form.

IRS Detroit Computing Center

-If the DOEP form is used to revoke an exemption,

Attn: Designation of Exempt Person

enter the day after the last transaction to be exempted.

Part V Biennial Renewal Certification

P .O. Box 33112

Detroit, MI 48232-0112

Part II Exempt Person Information

When filing a biennial renewal, a bank must certify

Item 3--Legal name of the exempt person. Enter

that it has applied as necessary, but at least annually, a

General Instructions

the full legal name of the exempt person as it is shown

system of monitoring the transactions in currency for

on the charter or other document creating the entity.

suspicious activity. If the box in item 19 is checked,

1. This form can be e-filed through the Bank

For exempt persons that are sole proprietorship, enter

the bank granting the exemption is responsible for

Secrecy Act E-filing System. Go to

the first and last name of the proprietor.

to

completing its own monitoring and due diligence in

Item 4--Doing business as (DBA). If applicable, en-

granting the exemption. The attached list of affiliated

register. This form is also available for download on

ter the separate DBA name of the exempt person.

banks is provided only to reflect the other financial

the Financial Crimes Enforcement Network’s Web

Item 5, 6, 7 and 8--Address. Enter the permanent

institutions that may recognize this exemption.

site at , or may be ordered by

address of the business location of the exempt per-

calling the IRS Forms Distribution Center at (800)

Item 25--Signature. An authorized official of the bank

son. For exempt persons doing business at more than

829-3676.

shall sign the certification. (Item 1b is checked)

one physical location, enter the local headquarters ad-

2. Complete the form in accordance with specific

Item 26-- Print name. Enter the name of the bank

dress or local address of the exempt person. For sole

instructions for each item. Unless there is a specific

official who signed the certification.

proprietorship, enter the business address of the sole

instruction to the contrary, leave blank any items that

Item 27--Title. Enter the title of the bank official who

proprietorship rather than the home address of the

do not apply.

signed the certification.

sole proprietor, unless they are the same.

3. Do not include supporting documents.

Item 28--Date of signature. Enter the date the

Item 9--EIN or SSN. Enter the EIN of the exempt

4. Enter all dates in MM / DD / YYYY format where

certification was signed.

person. If a sole proprietorship does not have an EIN,

MM=month, DD=day, and YYYY=year. Precede any

Item 29--Telephone number. Enter the phone

enter the social security number (SSN).

single number with a zero, i.e., 01,02, etc.

number of the bank official who signed the

Item 10--Type of exempt person. Check only one of

5. List all U.S. telephone numbers with area code

certification.

the six boxes. See 31 CFR 103.22(a).

first and then the seven-digit phone number, using

Item 11--Change in control. Complete this item only

the format (XXX) XXX-XXXX.

Paperwork Reduction Act Notice: The purpose of this form is to provide an effective means for banks and depository institutions to exempt eligible customers from currency

transaction reporting. This report is required by law, pursuant to 31 CFR 103.22. Federal law enforcement and regulatory agencies, including the U.S. Department of Treasury and

other authorized authorities, may use and share this information. You are not required to provide the requested information unless a form displays a valid OMB control number.

Public reporting and recordkeeping burden for this form is estimated to average 70 minutes per response, and includes time to gather and maintain information for the required

report, review the instructions, and complete the information collection. The record retention period is five years. Send comments regarding this burden estimate, including

suggeations for reduciing the burden, to Financial Crimes Enforcement Network, Attention: Paperwork Reduction Act, P . O. Box 39, Vienna, VA 22183-0039.

1

1 2

2