2013 IRS Tax Filing Requirements. If your 2013 income exceeded the amount noted below that applies to

your filing status then you are required to file a 2013 federal tax return.

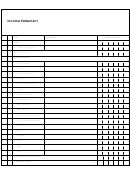

IF your filing status is:

AND at the end of 2013 you were:

THEN file a return if your gross

income was at least:

Single

Under 65

$10,000

65 and older

$11,500

Head of Household

Under 65

$12,850

65 and older

$14,350

Married, filing jointly

Under 65 (both spouses)

$20,000

65 or older (one spouses)

$21,200

65 or older (both spouses)

$22,400

Married, filing separately

Any age

$3,900

Qualifying widow(er) with dependent

Under 65

$16,100

65 or older

$17,300

If your income is zero or less than is required for your filing status*, please complete the Non-Filer Income statement,

sign and return to the Cal Poly Financial Aid Office.

*If you had net earnings from self-employment of at least $400, refer to IRS.gov for complete filing requirements.

If your parent(s) are required to file a 2013 federal tax return:

Federal verification requires that we confirm your income via one of the two processes noted below.

IRS DATA RETRIEVAL PROCESS or TAX RETURN TRANSCRIPT - You are required to submit your Parent's 2013

IRS tax information using either the FAFSA IRS Data Retrieval Process or by requesting a 2013Tax ReturnTranscript from

the IRS.

1.

IRS DATA RETRIEVAL PROCESS:

To use the IRS Data Retrieval Process (the recommended method if you are allowed to do so):

If you file electronically, approximately 3 weeks after filing, log on to the FAFSA Web site at and select

Make FAFSA Corrections link.

Change your tax information from “will file” to “have filed”. A series of questions will appear and if you are able, the

IRS Data Retrieval Option will be made available.

Follow the instructions to have the IRS data uploaded to your FAFSA record.

Complete the FAFSA update. Make sure Cal Poly is still listed as a school to receive the FAFSA record.

Cal Poly will then receive record of the updated FAFSA with the IRS confirmed income data.

2. TAX RETURN TRANSCRIPT:

If you cannot use the IRS Data Retrieval on the FAFSA, Tax Return Transcripts can be downloaded and printed from

the IRS Web site at or Please submit a copy to our office via

email, fax, or USPS mail. See the front of this form for details.

Per federal regulations, the only acceptable documentation is the IRS Data Retrieval Process or federal Tax Return

Transcript. No State Tax Returns are required or accepted.

Include student’s Cal Poly EMPL ID on all documents.

1

1 2

2