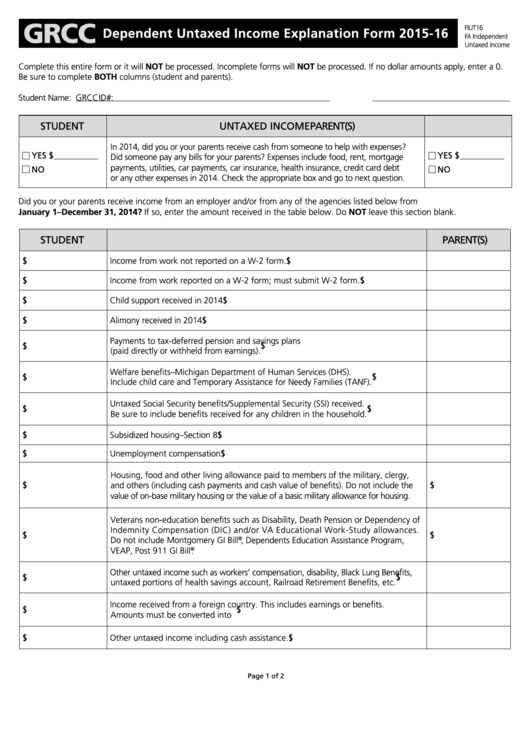

FIUT16

Dependent Untaxed Income Explanation Form 2015-16

FA Independent

Untaxed Income

Complete this entire form or it will NOT be processed. Incomplete forms will NOT be processed. If no dollar amounts apply, enter a 0.

Be sure to complete BOTH columns (student and parents).

Student Name:

GRCC ID#:

STUDENT

UNTAXED INCOME

PARENT(S)

In 2014, did you or your parents receive cash from someone to help with expenses?

YES $

YES $

Did someone pay any bills for your parents? Expenses include food, rent, mortgage

payments, utilities, car payments, car insurance, health insurance, credit card debt

NO

NO

or any other expenses in 2014. Check the appropriate box and go to next question.

Did you or your parents receive income from an employer and/or from any of the agencies listed below from

January 1–December 31, 2014? If so, enter the amount received in the table below. Do NOT leave this section blank.

STUDENT

PARENT(S)

$

Income from work not reported on a W-2 form.

$

$

$

Income from work reported on a W-2 form; must submit W-2 form.

$

Child support received in 2014

$

$

Alimony received in 2014

$

Payments to tax-deferred pension and savings plans

$

$

(paid directly or withheld from earnings).

Welfare benefits–Michigan Department of Human Services (DHS).

$

$

Include child care and Temporary Assistance for Needy Families (TANF).

Untaxed Social Security benefits/Supplemental Security (SSI) received.

$

$

Be sure to include benefits received for any children in the household.

$

$

Subsidized housing–Section 8

$

Unemployment compensation

$

Housing, food and other living allowance paid to members of the military, clergy,

$

and others (including cash payments and cash value of benefits). Do not include the

$

value of on-base military housing or the value of a basic military allowance for housing.

Veterans non-education benefits such as Disability, Death Pension or Dependency of

Indemnity Compensation (DIC) and/or VA Educational Work-Study allowances.

$

$

Do not include Montgomery GI Bill

, Dependents Education Assistance Program,

®

VEAP, Post 911 GI Bill

®

.

Other untaxed income such as workers’ compensation, disability, Black Lung Benefits,

$

$

untaxed portions of health savings account, Railroad Retirement Benefits, etc.

Income received from a foreign country. This includes earnings or benefits.

$

$

Amounts must be converted into U.S. dollars.

$

Other untaxed income including cash assistance.

$

Page 1 of 2

1

1 2

2