Income Tax Form For New Residents - Village Of Thurston

ADVERTISEMENT

Village of

Thurston

Mary Boring

Mayor

2215 Main Street • PO Box 188

Aaron Reedy

Thurston, Ohio 43157

Clerk-Treasurer

(740) 862-6003 • (740) 862-6423 FAX

New Thurston Residents:

The Village of Thurston has enacted a 1.0% (.01) municipal income tax on all income

earned by individuals residing or working in the Village of Thurston and on businesses

within the Village. The tax is effective July 1, 2010, and the Village allows (0.00) or no

tax credit for taxes paid to other municipalities.

Earned income includes items such as wages, salaries, tips, bonuses, rental income,

net profits from a business or profession, and distributions from partnerships. Examples

of items that would be exempt from the income tax are interest, dividends, annuities,

receipts from Social Security, pensions, military pay, unemployment compensation,

alimony, and child support.

The Village of Thurston has contracted with the Regional Income Tax Agency (R.I.T.A.)

to collect and administer the municipal income tax. R.I.T.A. has been administering

municipal income tax collection services since 1971 and currently services 179

municipalities throughout the State of Ohio.

At any time, you can contact this office for more information. You can also obtain more

information and forms for filing you tax at

As a new resident, it is important to report your information and that of your household

so that it can be filed with R.I.T.A. and you can be sent the information needed to file

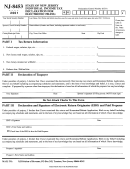

income (or exemption) in a timely manner. On the form attached, please list all

members of your household who are 18 years of age or older (whether or not they will

be exempt from paying municipal income tax).

Thank you for your attention to this matter. Should you have any questions, please feel

free to contact this office.

Sincerely,

Aaron Reedy

Clerk-Treasurer

Village of Thurston

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2