Statement For Nontax Filers - Bentley University

ADVERTISEMENT

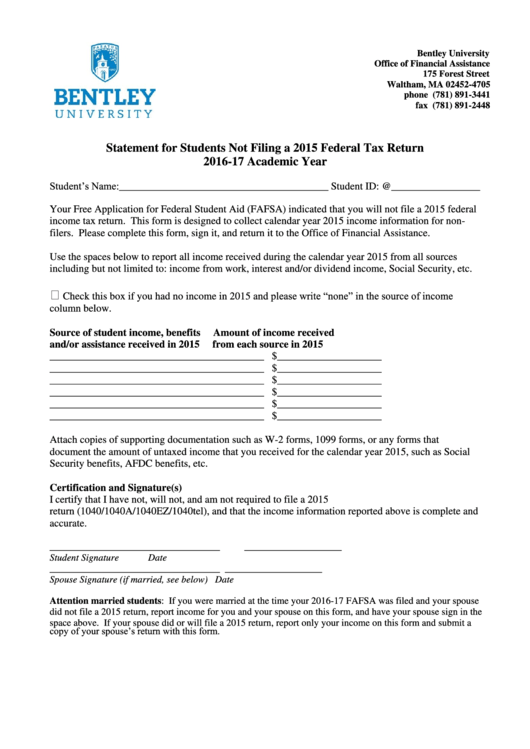

Bentley University

Office of Financial Assistance

175 Forest Street

Waltham, MA 02452-4705

phone (781) 891-3441

fax (781) 891-2448

Statement for Students Not Filing a 2015 Federal Tax Return

2016-17 Academic Year

Student’s Name:________________________________________ Student ID: @_________________

Your Free Application for Federal Student Aid (FAFSA) indicated that you will not file a 2015 federal

income tax return. This form is designed to collect calendar year 2015 income information for non-

filers. Please complete this form, sign it, and return it to the Office of Financial Assistance.

Use the spaces below to report all income received during the calendar year 2015 from all sources

including but not limited to: income from work, interest and/or dividend income, Social Security, etc.

Check this box if you had no income in 2015 and please write “none” in the source of income

column below.

Source of student income, benefits

Amount of income received

and/or assistance received in 2015

from each source in 2015

_________________________________________

$____________________

_________________________________________

$____________________

_________________________________________

$____________________

_________________________________________

$____________________

_________________________________________

$____________________

_________________________________________

$____________________

Attach copies of supporting documentation such as W-2 forms, 1099 forms, or any forms that

document the amount of untaxed income that you received for the calendar year 2015, such as Social

Security benefits, AFDC benefits, etc.

Certification and Signature(s)

I certify that I have not, will not, and am not required to file a 2015 U.S. or Puerto Rico Income Tax

return (1040/1040A/1040EZ/1040tel), and that the income information reported above is complete and

accurate.

___________________________________

____________________

Student Signature

Date

___________________________________

____________________

Spouse Signature (if married, see below)

Date

Attention married students: If you were married at the time your 2016-17 FAFSA was filed and your spouse

did not file a 2015 return, report income for you and your spouse on this form, and have your spouse sign in the

space above. If your spouse did or will file a 2015 return, report only your income on this form and submit a

copy of your spouse’s return with this form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1