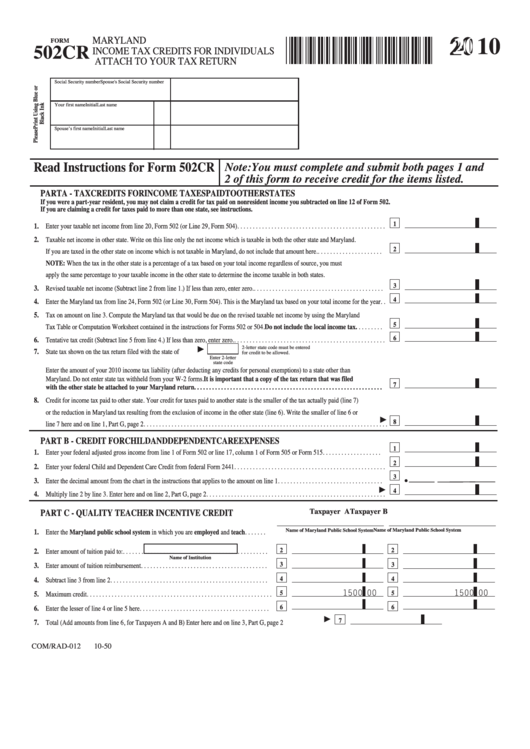

Form 502cr - Maryland Income Tax Credits For Individuals - 2010

ADVERTISEMENT

MARYLAND

2010

FORM

502CR

INCOME TAX CREDITS FOR INDIVIDUALS

ATTACH TO YOUR TAX RETURN

Social Security number

Spouse's Social Security number

Your first name

Initial

Last name

Spouse’s first name

Initial

Last name

Read Instructions for Form 502CR

Note: You must complete and submit both pages 1 and

2 of this form to receive credit for the items listed.

PART A - TAX CREDITS FOR INCOME TAXES PAID TO OTHER STATES

If you were a part-year resident, you may not claim a credit for tax paid on nonresident income you subtracted on line 12 of Form 502.

If you are claiming a credit for taxes paid to more than one state, see instructions.

1

1.

Enter your taxable net income from line 20, Form 502 (or Line 29, Form 504) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

Taxable net income in other state. Write on this line only the net income which is taxable in both the other state and Maryland.

2

If you are taxed in the other state on income which is not taxable in Maryland, do not include that amount here. . . . . . . . . . . . . . . . . . . . . .

NOTE: When the tax in the other state is a percentage of a tax based on your total income regardless of source, you must

apply the same percentage to your taxable income in the other state to determine the income taxable in both states.

3

3.

Revised taxable net income (Subtract line 2 from line 1.) If less than zero, enter zero. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4.

Enter the Maryland tax from line 24, Form 502 (or Line 30, Form 504). This is the Maryland tax based on your total income for the year . .

5.

Tax on amount on line 3. Compute the Maryland tax that would be due on the revised taxable net income by using the Maryland

5

Tax Table or Computation Worksheet contained in the instructions for Forms 502 or 504. Do not include the local income tax. . . . . . . . .

6

6.

Tentative tax credit (Subtract line 5 from line 4.) If less than zero, enter zero. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2-letter state code must be entered

7.

State tax shown on the tax return filed with the state of

for credit to be allowed.

Enter 2-letter

state code

Enter the amount of your 2010 income tax liability (after deducting any credits for personal exemptions) to a state other than

Maryland. Do not enter state tax withheld from your W-2 forms. It is important that a copy of the tax return that was filed

7

with the other state be attached to your Maryland return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

Credit for income tax paid to other state. Your credit for taxes paid to another state is the smaller of the tax actually paid (line 7)

or the reduction in Maryland tax resulting from the exclusion of income in the other state (line 6). Write the smaller of line 6 or

8

line 7 here and on line 1, Part G, page 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART B - CREDIT FOR CHILD AND DEPENDENT CARE EXPENSES

1

1.

Enter your federal adjusted gross income from line 1 of Form 502 or line 17, column 1 of Form 505 or Form 515 . . . . . . . . . . . . . . . . . . .

2

2.

Enter your federal Child and Dependent Care Credit from federal Form 2441 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

3

_____ _____ __ ___ __ ___

3.

Enter the decimal amount from the chart in the instructions that applies to the amount on line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4.

Multiply line 2 by line 3. Enter here and on line 2, Part G, page 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Taxpayer A

Taxpayer B

PART C - QUALITY TEACHER INCENTIVE CREDIT

Name of Maryland Public School System

Name of Maryland Public School System

1.

Enter the Maryland public school system in which you are employed and teach. . . . . . .

2

2

2.

Enter amount of tuition paid to: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Name of Institution

3

3

3.

Enter amount of tuition reimbursement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4

4.

Subtract line 3 from line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1500 00

1500 00

5

5

5.

Maximum credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6

6.

Enter the lesser of line 4 or line 5 here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7.

Total (Add amounts from line 6, for Taxpayers A and B) Enter here and on line 3, Part G, page 2 . . . . . . . . . . .

COM/RAD-012

10-50

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2