403 B Hardship Authorization Form - Jefferson County Schools

ADVERTISEMENT

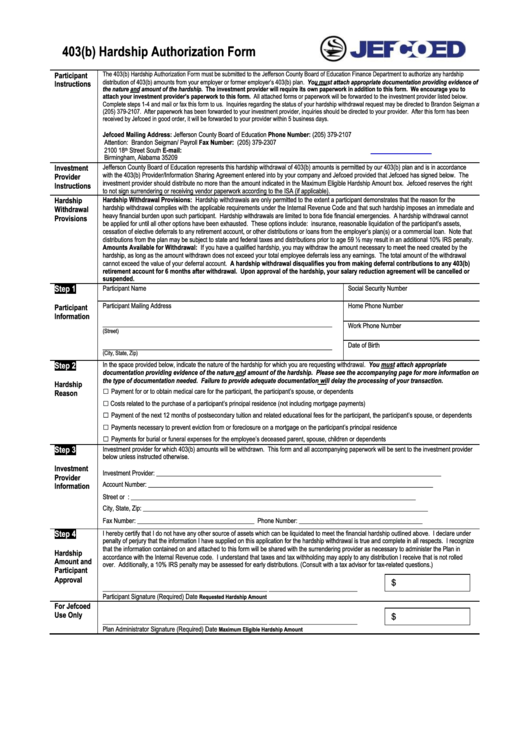

403(b) Hardship Authorization Form

Participant

The 403(b) Hardship Authorization Form must be submitted to the Jefferson County Board of Education Finance Department to authorize any hardship

distribution of 403(b) amounts from your employer or former employer’s 403(b) plan. You must attach appropriate documentation providing evidence of

Instructions

the nature and amount of the hardship. The investment provider will require its own paperwork in addition to this form. We encourage you to

attach your investment provider’s paperwork to this form. All attached forms or paperwork will be forwarded to the investment provider listed below.

Complete steps 1-4 and mail or fax this form to us. Inquiries regarding the status of your hardship withdrawal request may be directed to Brandon Seigman at

(205) 379-2107. After paperwork has been forwarded to your investment provider, inquiries should be directed to your provider. After this form has been

received by Jefcoed in good order, it will be forwarded to your provider within 5 business days.

Jefcoed Mailing Address:

Jefferson County Board of Education

Phone Number:

(205) 379-2107

Attention: Brandon Seigman/ Payroll

Fax Number:

(205) 379-2307

2100 18

Street South

E-mail:

th

Birmingham, Alabama 35209

Investment

Jefferson County Board of Education represents this hardship withdrawal of 403(b) amounts is permitted by our 403(b) plan and is in accordance

with the 403(b) Provider/Information Sharing Agreement entered into by your company and Jefcoed provided that Jefcoed has signed below. The

Provider

investment provider should distribute no more than the amount indicated in the Maximum Eligible Hardship Amount box. Jefcoed reserves the right

Instructions

to not sign surrendering or receiving vendor paperwork according to the ISA (if applicable).

Hardship

Hardship Withdrawal Provisions: Hardship withdrawals are only permitted to the extent a participant demonstrates that the reason for the

hardship withdrawal complies with the applicable requirements under the Internal Revenue Code and that such hardship imposes an immediate and

Withdrawal

heavy financial burden upon such participant. Hardship withdrawals are limited to bona fide financial emergencies. A hardship withdrawal cannot

Provisions

be applied for until all other options have been exhausted. These options include: insurance, reasonable liquidation of the participant’s assets,

cessation of elective deferrals to any retirement account, or other distributions or loans from the employer’s plan(s) or a commercial loan. Note that

distributions from the plan may be subject to state and federal taxes and distributions prior to age 59 ½ may result in an additional 10% IRS penalty.

Amounts Available for Withdrawal: If you have a qualified hardship, you may withdraw the amount necessary to meet the need created by the

hardship, as long as the amount withdrawn does not exceed your total employee deferrals less any earnings. The total amount of the withdrawal

cannot exceed the value of your deferral account. A hardship withdrawal disqualifies you from making deferral contributions to any 403(b)

retirement account for 6 months after withdrawal. Upon approval of the hardship, your salary reduction agreement will be cancelled or

suspended.

Step 1

Participant Name

Social Security Number

Participant Mailing Address

Home Phone Number

Participant

Information

_________________________________________________________________

Work Phone Number

(Street)

Date of Birth

_________________________________________________________________

(City, State, Zip)

Step 2

In the space provided below, indicate the nature of the hardship for which you are requesting withdrawal. You must attach appropriate

documentation providing evidence of the nature and amount of the hardship. Please see the accompanying page for more information on

the type of documentation needed. Failure to provide adequate documentation will delay the processing of your transaction.

Hardship

□

Payment for or to obtain medical care for the participant, the participant’s spouse, or dependents

Reason

□

Costs related to the purchase of a participant’s principal residence (not including mortgage payments)

□

Payment of the next 12 months of postsecondary tuition and related educational fees for the participant, the participant’s spouse, or dependents

□

Payments necessary to prevent eviction from or foreclosure on a mortgage on the participant’s principal residence

□

Payments for burial or funeral expenses for the employee’s deceased parent, spouse, children or dependents

Step 3

Investment provider for which 403(b) amounts will be withdrawn. This form and all accompanying paperwork will be sent to the investment provider

below unless instructed otherwise.

Investment

Investment Provider:

__________________________________________________________________________________________

Provider

Account Number:

__________________________________________________________________________________________

Information

Street or P.O. Box:

__________________________________________________________________________________________

City, State, Zip:

__________________________________________________________________________________________

Fax Number:

_____________________________________ Phone Number: _______________________________________

Step 4

I hereby certify that I do not have any other source of assets which can be liquidated to meet the financial hardship outlined above. I declare under

penalty of perjury that the information I have supplied on this application for the hardship withdrawal is true and complete in all respects. I recognize

that the information contained on and attached to this form will be shared with the surrendering provider as necessary to administer the Plan in

Hardship

accordance with the Internal Revenue code. I understand that taxes and tax withholding may apply to any distribution I receive that is not rolled

Amount and

over. Additionally, a 10% IRS penalty may be assessed for early distributions. (Consult with a tax advisor for tax-related questions.)

Participant

Approval

$

____________________________________________________

____________________________

Participant Signature (Required)

Date

Requested Hardship Amount

For Jefcoed

Use Only

$

____________________________________________________

____________________________

Plan Administrator Signature (Required)

Date

Maximum Eligible Hardship Amount

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2