Schedule C / Form 2106 Worksheet - Visual Artist / Performing Artist

ADVERTISEMENT

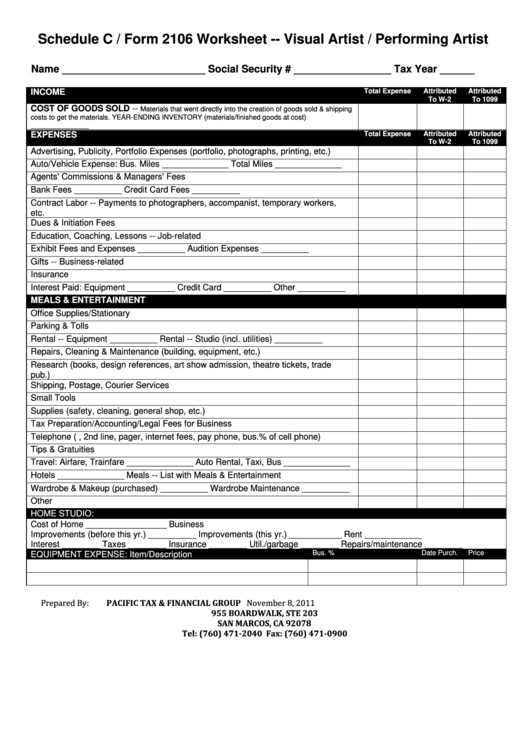

Schedule C / Form 2106 Worksheet -- Visual Artist / Performing Artist

Name _________________________ Social Security # _________________ Tax Year ______

Total Expense

Attributed

Attributed

INCOME

To W-2

To 1099

COST OF GOODS SOLD --

Materials that went directly into the creation of goods sold & shipping

costs to get the materials. YEAR-ENDING INVENTORY (materials/finished goods at cost)

_______________

Total Expense

Attributed

Attributed

EXPENSES

To W-2

To 1099

Advertising, Publicity, Portfolio Expenses (portfolio, photographs, printing, etc.)

Auto/Vehicle Expense: Bus. Miles ______________ Total Miles ______________

Agents' Commissions & Managers' Fees

Bank Fees __________ Credit Card Fees __________

Contract Labor -- Payments to photographers, accompanist, temporary workers,

etc.

Dues & Initiation Fees

Education, Coaching, Lessons -- Job-related

Exhibit Fees and Expenses __________ Audition Expenses __________

Gifts -- Business-related

Insurance

Interest Paid: Equipment __________ Credit Card __________ Other __________

MEALS & ENTERTAINMENT

Office Supplies/Stationary

Parking & Tolls

Rental -- Equipment __________ Rental -- Studio (incl. utilities) __________

Repairs, Cleaning & Maintenance (building, equipment, etc.)

Research (books, design references, art show admission, theatre tickets, trade

pub.)

Shipping, Postage, Courier Services

Small Tools

Supplies (safety, cleaning, general shop, etc.)

Tax Preparation/Accounting/Legal Fees for Business

Telephone (bus.line, 2nd line, pager, internet fees, pay phone, bus.% of cell phone)

Tips & Gratuities

Travel: Airfare, Trainfare ______________ Auto Rental, Taxi, Bus ______________

Hotels ______________ Meals -- List with Meals & Entertainment

Wardrobe & Makeup (purchased) __________ Wardrobe Maintenance __________

Other

HOME STUDIO:

Cost of Home _________________ Business Sq.Ft.___________ Total Sq.Ft.______________

Improvements (before this yr.) __________ Improvements (this yr.) ___________ Rent ____________

Interest ________ Taxes ________ Insurance ________ Util./garbage ________ Repairs/maintenance ________

EQUIPMENT EXPENSE: Item/Description

Bus. %

Date Purch.

Price

Prepared By:

PACIFIC TAX & FINANCIAL GROUP

November 8, 2011

955 BOARDWALK, STE 203

SAN MARCOS, CA 92078

Tel: (760) 471-2040 Fax: (760) 471-0900

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1