Articles Of Incorporation For Domestic Nonprofit Corporation Form - Secretary Of State - 2013

ADVERTISEMENT

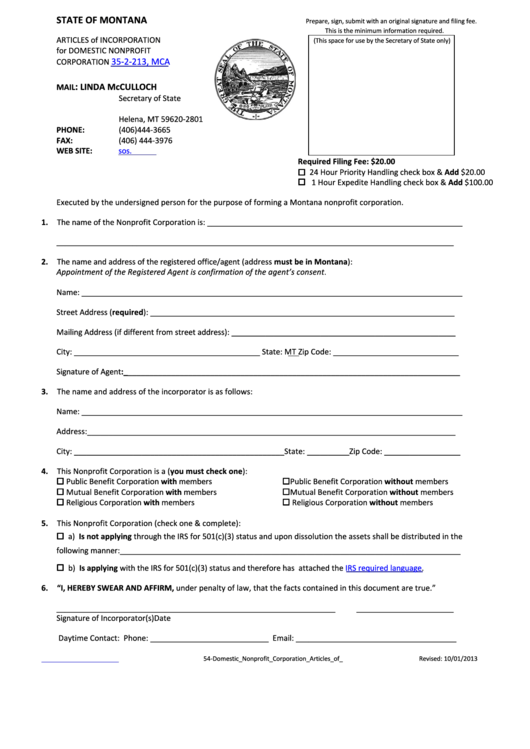

STATE OF MONTANA

Prepare, sign, submit with an original signature and filing fee.

This is the minimum information required.

ARTICLES of INCORPORATION

(This space for use by the Secretary of State only)

for DOMESTIC NONPROFIT

35-2-213, MCA

CORPORATION

:

LINDA McCULLOCH

MAIL

Secretary of State

P.O. Box 202801

Helena, MT 59620-2801

PHONE:

(406) 444-3665

FAX:

(406) 444-3976

WEB SITE:

sos.mt.gov

Required Filing Fee: $20.00

24 Hour Priority Handling check box & Add $20.00

1 Hour Expedite Handling check box & Add $100.00

Executed by the undersigned person for the purpose of forming a Montana nonprofit corporation.

1. The name of the Nonprofit Corporation is: ___________________________________________________________

______________________________________________________________________________________________

2. The name and address of the registered office/agent (address must be in Montana):

Appointment of the Registered Agent is confirmation of the agent’s consent

.

Name: ________________________________________________________________________________________

Street Address (required): ________________________________________________________________________

Mailing Address (if different from street address): _____________________________________________________

City: ____________________________________________ State: MT Zip Code: _____________________________

Signature of Agent:______________________________________________________________________________

3. The name and address of the incorporator is as follows:

Name: ________________________________________________________________________________________

Address:_______________________________________________________________________________________

City: _________________________________________________State: __________Zip Code: __________________

4. This Nonprofit Corporation is a (you must check one):

Public Benefit Corporation with members

Public Benefit Corporation without members

Mutual Benefit Corporation with members

Mutual Benefit Corporation without members

Religious Corporation with members

Religious Corporation without members

5. This Nonprofit Corporation (check one & complete):

a) Is not applying through the IRS for 501(c)(3) status and upon dissolution the assets shall be distributed in the

following manner:_______________________________________________________________________________

b) Is applying with the IRS for 501(c)(3) status and therefore has attached the

IRS required

language.

6. “I, HEREBY SWEAR AND AFFIRM, under penalty of law, that the facts contained in this document are true.”

__________________________________________________________________

_______________________

Signature of Incorporator(s)

Date

Daytime Contact: Phone: ____________________________ Email: ______________________________________

sos.mt.gov/Business/Forms

54-Domestic_Nonprofit_Corporation_Articles_of_Incorporation.doc

Revised: 10/01/2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3