Check2

Check1

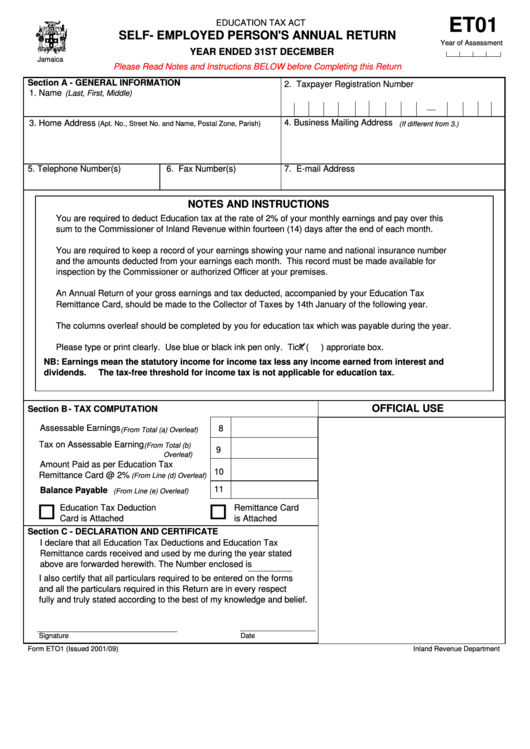

ET01

EDUCATION TAX ACT

SELF- EMPLOYED PERSON'S ANNUAL RETURN

Y ear of Assessment

YEAR ENDED 31ST DECEMBER

Jamaica

Please Read Notes and Instructions BELOW before Completing this Return

Section A - GENERAL INFORMATION

2. Taxpayer Registration Number

1. Name

(Last, First, Middle)

4. Business Mailing Address

3. Home Address

(Apt. No., Street No. and Name, Postal Zone, Parish)

(If different from 3.)

5. Telephone Number(s)

6. Fax Number(s)

7. E-mail Address

NOTES AND INSTRUCTIONS

You are required to deduct Education tax at the rate of 2% of your monthly earnings and pay over this

sum to the Commissioner of Inland Revenue w ithin fourteen (14) days after the end of each month.

You are required to keep a record of your earnings show ing your name and national insurance number

and the amounts deducted from your earnings each month. This record must be made available for

inspection by the Commissioner or authorized Officer at your premises.

An Annual Return of your gross earnings and tax deducted, accompanied by your Education Tax

Remittance Card, should be made to the Collector of Taxes by 14th January of the follow ing year.

The columns overleaf should be completed by you for education tax w hich w as payable during the year.

Please type or print clearly. Use blue or black ink pen only. Tick (

) approriate box.

NB: Earnings mean the statutory income for income tax less any income earned from interest and

dividends.

The tax-free threshold for income tax is not applicable for education tax.

OFFICIAL USE

Section B- TAX COMPUTATION

Assessable Earnings

8

(From Total (a) Overleaf)

Tax on Assessable Earning

(From Total (b)

9

Overleaf)

Amount Paid as per Education Tax

10

Remittance Card @ 2%

(From Line (d) Overleaf)

11

Balance Payable

(From Line (e) Overleaf)

Education Tax Deduction

Remittance Card

Card is Attached

is Attached

Section C - DECLARATION AND CERTIFICATE

I declare that all Education Tax Deductions and Education Tax

Remittance cards received and used by me during the year stated

above are forw arded herew ith. The Number enclosed is

I also certify that all particulars required to be entered on the forms

and all the particulars required in this Return are in every respect

fully and truly stated according to the best of my know ledge and belief.

Signature

Date

Form ETO1 (Issued 2001/09)

Inland Rev enue Department

1

1 2

2