Form Ct-588 - Athlete Or Entertainer Request For Reduced Withholding

ADVERTISEMENT

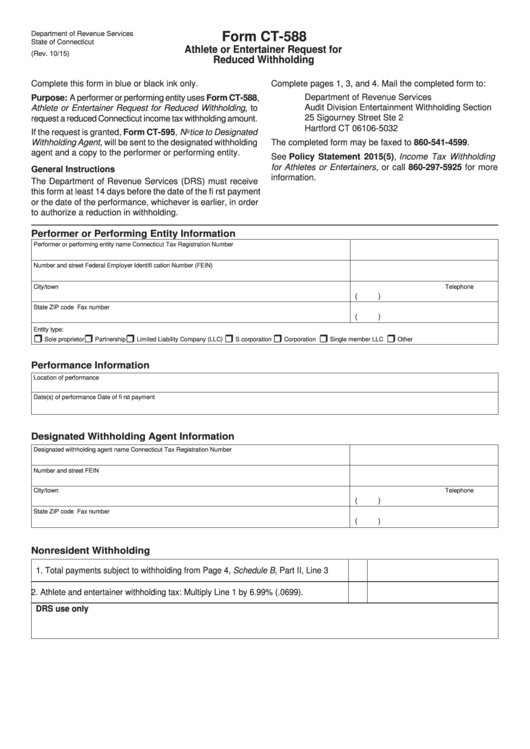

Department of Revenue Services

Form CT-588

State of Connecticut

Athlete or Entertainer Request for

(Rev. 10/15)

Reduced Withholding

Complete this form in blue or black ink only.

Complete pages 1, 3, and 4. Mail the completed form to:

Department of Revenue Services

Purpose: A performer or performing entity uses Form CT-588,

Audit Division Entertainment Withholding Section

Athlete or Entertainer Request for Reduced Withholding, to

25 Sigourney Street Ste 2

request a reduced Connecticut income tax withholding amount.

Hartford CT 06106-5032

If the request is granted, Form CT-595, Notice to Designated

Withholding Agent, will be sent to the designated withholding

The completed form may be faxed to 860-541-4599.

agent and a copy to the performer or performing entity.

See Policy Statement 2015(5), Income Tax Withholding

for Athletes or Entertainers, or call 860-297-5925 for more

General Instructions

information.

The Department of Revenue Services (DRS) must receive

this form at least 14 days before the date of the fi rst payment

or the date of the performance, whichever is earlier, in order

to authorize a reduction in withholding.

Performer or Performing Entity Information

Performer or performing entity name

Connecticut Tax Registration Number

Number and street

Federal Employer Identifi cation Number (FEIN)

City/town

Telephone number

(

)

State

ZIP code

Fax number

(

)

Entity type:

Sole proprietor

Partnership

Limited Liability Company (LLC)

S corporation

Corporation

Single member LLC

Other

Performance Information

Location of performance

Date(s) of performance

Date of fi rst payment

Designated Withholding Agent Information

Designated withholding agent name

Connecticut Tax Registration Number

Number and street

FEIN

City/town

Telephone number

(

)

State

ZIP code

Fax number

(

)

Nonresident Withholding

1. Total payments subject to withholding from Page 4, Schedule B, Part II, Line 3 ......

1

2. Athlete and entertainer withholding tax: Multiply Line 1 by 6.99% (.0699). ...............

2

DRS use only

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4