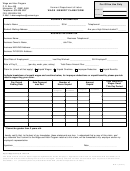

Critical Illness Benefit Claim Form Page 2

ADVERTISEMENT

Important Notice

In some states we are required to advise you of the following: ny person who knowingly intends to defraud or facilitates a fraud against an insurer by submitting

an application or filing a false claim, or makes an incomplete or deceptive statement of material fact, may be guilty of insurance fraud.

labama: ny person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an

application for insurance is guilty of a crime and may be subject to restitution fines or confinement in prison, or any combination thereof.

laska:

person who knowingly and with intent to injure, defraud, or deceive an insurance company files a claim containing false, incomplete or misleading

information may be prosecuted under state law.

rizona: For your protection rizona law requires the following statement to appear on this form. ny person who knowingly presents a false or fraudulent claim for

payment of a loss is subject to criminal and civil penalties.

rkansas, Louisiana, Maryland, New Mexico, Rhode Island, Texas, West Virginia: ny person who knowingly presents a false or fraudulent claim for payment of

a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

California: For your protection California law requires the following to appear on this form: ny person who knowingly presents a false or fraudulent claim for the

payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Colorado: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding and

attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. ny insurance company or agent of an

insurance company who knowingly provided false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or

attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division

of Insurance within the Department of Regulatory gencies.

Delaware, Oklahoma, Idaho, Indiana: W RNING - ny person who knowingly, and with intent to injure, defraud or deceive any insurer, files a statement of claim

containing any false, incomplete or misleading information is guilty of a felony.

District of Columbia, Maine, Tennessee, Virginia, Washington: W RNING: It is a crime to knowingly provide false or misleading information to an insurance

company for the purpose of defrauding the company. Penalties may include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false

information materially related to a claim was provided by the applicant.

Florida: ny person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false,

incomplete, or misleading information is guilty of a felony of the third degree.

Kentucky: ny person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false

information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

Minnesota:

person who files a claim with intent to defraud or helps commit a fraud against an insurer is guilty of a crime.

New Hampshire: ny person who, with a purpose to injure, defraud or deceive any insurance company, files a statement of claim containing any false, incomplete

or misleading information is subject to prosecution and punishment for insurance fraud, as provided in RS 638:20.

New Jersey: ny person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

New York: ny person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim

containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent

insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such

violation.

Ohio: ny person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false

or deceptive statement is guilty of insurance fraud.

Pennsylvania: ny person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim

containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent

insurance act, which is a crime and subjects such person to criminal and civil penalties.

LL OTHER RESIDENTS:

law of your state requires us to inform you that any person who knowingly and with intent to defraud any insurance company or other

person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information

concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Owner's Certification of Social Security Number/Taxpayer Identification Number

IRS Certification: Under penalties of perjury, I certify that: (1) The number shown on this form is my correct taxpayer identification number (or

I am waiting for a number to be issued to me), and (2) I am not subject to backup withholding because: (a) I am exempt from backup withholding

(enter exempt payee code*, if applicable: _____), OR (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to

backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup

withholding, and (3) I am a U.S. citizen or other U.S. person*, and (4) The F TC code(s) entered on this form (if any) indicating that I am exempt

from F TC reporting is correct (enter exemption from F TC reporting code, if applicable: _____).** Certification instructions. You must cross

out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all

interest and dividends on your tax return. For contributions to an individual retirement arrangement (IR ) and, generally, payments other than

interest and dividends, you are not required to sign the certification, but you must provide your correct TIN. *See General Instructions provided

on the IRS Form W-9 available from IRS.gov. ** If you are a U.S. citizen or U.S. resident alien, F TC reporting does not apply to you.

Social Security Number/Taxpayer Identification Number ___________________________________________________________________

I understand that no insurance agent of the Company is authorized to make any claim decision or any representation as to whether any claim

should or will be paid.

I agree to cooperate with the Company in its investigation of this claim by

providing assistance including, but not limited to, completing, signing, and

submitting any questionnaire or authorization form needed by the Company,

Signature of Owner

in its sole opinion, to conduct its investigation.

The Internal Revenue does not require your consent to any provision of this

Date____________________________

document other than the certification required to avoid backup withholding.

Page 2 of 3

GL 185 REV0915

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3