New Hampshire Nonprofit Eligibility Checklist Template

ADVERTISEMENT

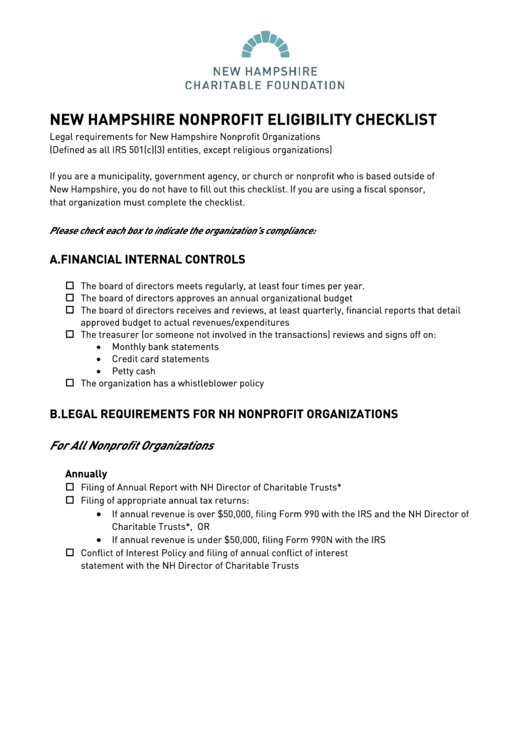

NEW HAMPSHIRE NONPROFIT ELIGIBILITY CHECKLIST

Legal requirements for New Hampshire Nonprofit Organizations

(Defined as all IRS 501(c)(3) entities, except religious organizations)

If you are a municipality, government agency, or church or nonprofit who is based outside of

New Hampshire, you do not have to fill out this checklist. If you are using a fiscal sponsor,

that organization must complete the checklist.

Please check each box to indicate the organization’s compliance:

A. FINANCIAL INTERNAL CONTROLS

The board of directors meets regularly, at least four times per year.

The board of directors approves an annual organizational budget

The board of directors receives and reviews, at least quarterly, financial reports that detail

approved budget to actual revenues/expenditures

The treasurer (or someone not involved in the transactions) reviews and signs off on:

Monthly bank statements

Credit card statements

Petty cash

The organization has a whistleblower policy

B. LEGAL REQUIREMENTS FOR NH NONPROFIT ORGANIZATIONS

For All Nonprofit Organizations

Annually

Filing of Annual Report with NH Director of Charitable Trusts*

Filing of appropriate annual tax returns:

If annual revenue is over $50,000, filing Form 990 with the IRS and the NH Director of

Charitable Trusts*, OR

If annual revenue is under $50,000, filing Form 990N with the IRS

Conflict of Interest Policy and filing of annual conflict of interest

statement with the NH Director of Charitable Trusts

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3