Verification Worksheet Federal Student Aid Programs - 2015-2016

ADVERTISEMENT

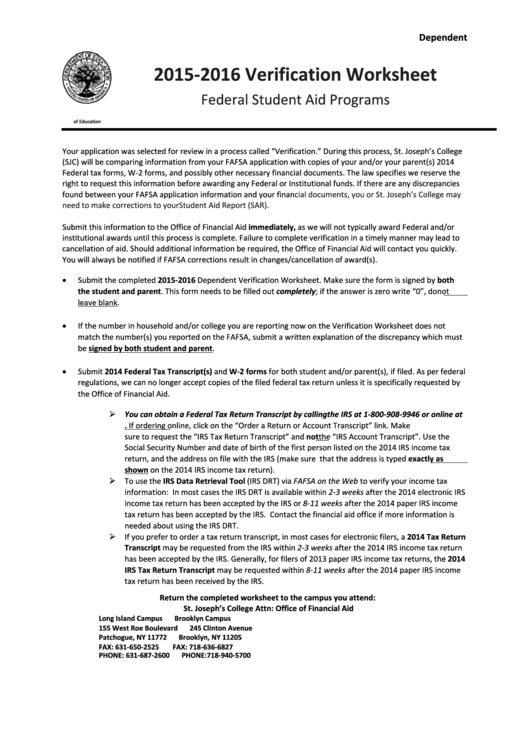

Dependent

2015‐2016 Verification Worksheet

Federal Student Aid Programs

U.S. Department

of Education

Your application was selected for review in a process called “Verification.” During this process, St. Joseph’s College

(SJC) will be comparing information from your FAFSA application with copies of your and/or your parent(s) 2014

Federal tax forms, W-2 forms, and possibly other necessary financial documents. The law specifies we reserve the

right to request this information before awarding any Federal or Institutional funds. If there are any discrepancies

found between your FAFSA application information and your

financial documents, you or St. Joseph’s College may

need to make corrections to your Student Aid Report (SAR).

Submit this information to the Office of Financial Aid immediately, as we will not typically award Federal and/or

institutional awards until this process is complete. Failure to complete verification in a timely manner may lead to

cancellation of aid. Should additional information be required, the Office of Financial Aid will contact you quickly.

You will always be notified if FAFSA corrections result in changes/cancellation of award(s).

Submit the completed 2015-2016 Dependent Verification Worksheet. Make sure the form is signed by both

the student and parent. This form needs to be filled out completely; if the answer is zero write “0”, do not

leave blank.

If the number in household and/or college you are reporting now on the Verification Worksheet does not

match the number(s) you reported on the FAFSA, submit a written explanation of the discrepancy which must

be signed by both student and parent.

Submit 2014 Federal Tax Transcript(s) and W-2 forms for both student and/or parent(s), if filed. As per federal

regulations, we can no longer accept copies of the filed federal tax return unless it is specifically requested by

the Office of Financial Aid.

You can obtain a Federal Tax Return Transcript by calling the IRS at 1-800-908-9946 or online at

If ordering online, click on the “Order a Return or Account Transcript” link. Make

sure to request the “IRS Tax Return Transcript” and not the “IRS Account Transcript”. Use the

Social Security Number and date of birth of the first person listed on the 2014 IRS income tax

return, and the address on file with the IRS (make sure that the address is typed exactly as

shown on the 2014 IRS income tax return).

To use the IRS Data Retrieval Tool (IRS DRT) via FAFSA on the Web to verify your income tax

information: In most cases the IRS DRT is available within 2-3 weeks after the 2014 electronic IRS

income tax return has been accepted by the IRS or 8-11 weeks after the 2014 paper IRS income

tax return has been accepted by the IRS. Contact the financial aid office if more information is

needed about using the IRS DRT.

If you prefer to order a tax return transcript, in most cases for electronic filers, a 2014 Tax Return

Transcript may be requested from the IRS within 2-3 weeks after the 2014 IRS income tax return

has been accepted by the IRS. Generally, for filers of 2013 paper IRS income tax returns, the 2014

IRS Tax Return Transcript may be requested within 8-11 weeks after the 2014 paper IRS income

tax return has been received by the IRS.

Return the completed worksheet to the campus you attend:

St. Joseph’s College Attn: Office of Financial Aid

Long Island Campus

Brooklyn Campus

155 West Roe Boulevard

245 Clinton Avenue

Patchogue, NY 11772

Brooklyn, NY 11205

FAX: 631-650-2525

FAX: 718-636-6827

PHONE: 631-687-2600

PHONE:718-940-5700

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4