Personal Mileage Vehicle Log Sheet Page 2

ADVERTISEMENT

WORK SERVICES CORPORATION

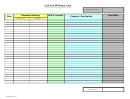

Month____________________

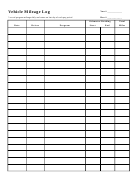

PERSONAL MILEAGE

VEHICLE LOG

This form is used when using your company car for personal use.

1. Fill out Vehicle Fringe Benefit Mileage Sheet included in this file at the end of each month.

2. Show only Personal Miles used, which includes trips to and from work and any other personal

mileage used.

3. Travel to and from Work is considered personal mileage, regardless of the circumstances. For Example,

if you are called in for unscheduled duty, mileage to and from Work is still considered personal mileage.

4. WSC requests that you keep personal mileage in company vehicles to a minimum for uses other than

driving to and from work.

5. An email should be sent to the CFO at the beginning of July and January each year with the current

odometer reading.

6. If you change vehicles during the year, be sure and send the odometer reading to the CFO then, also.

7. Your Fringe Benefit amount will be calculated on the form and entered into the payroll as part of your

Gross Wages, then deducted out. This process is to provide this information to the IRS for tax purposes.

8. Please turn the copy in to the Payroll Dept at the Corporate Headquarters. They will provide a copy to your

supervisor.

FORMS2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Miscellaneous

1

1 2

2