Ghana Revenue Authority Taxpayer Registration Form - Individual Page 3

ADVERTISEMENT

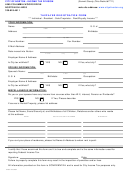

TAXPAYER REGISTRATION FORM – INDIVIDUAL

COMPLETION NOTES

SECTION

NOTES

GENERAL

Complete Form in BLOCK characters in Black or Blue ink only. Spell out all words - Do not use Abbreviations.

All dates are formatted as dd/mm/yyyy. For example 04/06/2011 is 4th June, 2011.

If FIELD information is Not Applicable please enter N/A.

S

1

ECTION

Tick YES, if you are a registered taxpayer and / or have a TIN, otherwise tick NO.

PRIOR

REGISTRATION

S

2

Tick appropriate check box(es).

ECTION

Self Employed, if self employed

CATEGORY

Employee, if you are employee of a business concern

Foreign Mission Employee , for employees of international organizations who have been identified and

approved by the Ministry of Foreign affairs as such under international conventions. Ghanaian and foreign

nationals not identified as such by the Ministry of Foreign Affairs who work for international organizations

should select employee

Other, specify, e.g. Student.

Title - Tick one only;

S

3

ECTION

Middle Name(s) - all other legal names (no aliases) other than first and last name.

PERSONAL

Last name - Same as SURNAME;

DETAILS

Previous Last name - same as Previous Surname (due to legal change of name or by marriage)

Gender : Tick appropriate box

Main Occupation: Indicate your main occupation e.g. Civil Servant

Marital status: Tick appropriate box.

Birth Country: if birth country is not Ghana, enter N/A for birth region and district

Resident: This specifies your residency status

For Tax Administration in Ghana, Resident individual means;

(1) an individual is a resident individual if that individual is

a. a citizen of Ghana, other than a citizen who has a permanent home outside Ghana for the whole of the

calendar year.

b. present in Ghana for a period, or periods amounting in aggregate to, 183 days or more in any twelve-

month period that commences or ends during the calendar year

c. an employee or official of the Government of Ghana posted abroad during the calendar year or

d. a citizen who is temporarily absent from Ghana for a period not exceeding 365 continuous days where that

citizen has a permanent home in Ghana.

Other Information: Select or Tick those that apply. Are you an Importer, Exporter, or Tax Consultant

Mother's maiden last name: This is your mother's maiden surname.

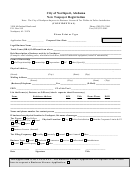

S

4

If you are already a registered taxpayer, specify

ECTION

IRS Tax Office, office where you transacted tax business

PREVIOUS TAX

Old Taxpayer Identification Number, the 10 character ‘old’ TIN assigned

REGISTRATION

IRS tax file number, the file number allocated

Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2 3

3 4

4