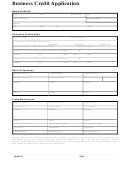

Business Credit Application Page 2

ADVERTISEMENT

1. GENERAL: In this Agreement, the words “you”, “your”, “Applicant” and “Customer” refer, as

us orally. You agree that unauthorized use does not include use by a person whom you have

appropriate, to the person or entity for which an Account is established under this Agreement and

authorized to use the Account and you will be liable for all such use. Subject to the requirements

any previous account or Agreement with the entities in this section. This Agreement shall be deemed

of applicable law, we may cancel your Account if you fail to notify us immediately of any loss, theft

to include and be an addition to and modification to any account, payment, or license agreements

or, unauthorized use.

with AutoZone. Any personal guarantor of this Agreement and any authorized user of the Account,

10.

TAX EXEMPT TRANSACTIONS:

We will honor tax exempt transactions with proper

including any person who signs an Application for an Account and/or the person or entity on whose

documentation. You must provide us with a copy of the appropriate tax-exempt documentation for

behalf such Application is signed, shall be bound by the terms and conditions of this Agreement.

your state. If sales taxes appear on your billing statement or invoice, take your billing statement

“Account” means any Account, as applicable, established in accordance with this Agreement. “We”,

or invoice to your AutoZone store for an adjustment.

“us”, “our”, “Creditor” and “AutoZone” refer to the subsidiary of AutoZone, Inc. with which you are

11.

CHANGES TO THE AGREEMENT:

We may add a new term or change any term of this

doing business (including, but not limited to AutoZone Parts, Inc., AutoZone Stores, Inc., AutoZone

Agreement at any time, including, for example, if applicable, adding late charges or other charges.

West, Inc., AutoZone Northeast, Inc., AutoZone Texas, L.P., AutoZone Operations, Inc., AutoZone

We will give you notice of any change in accordance with applicable law. Unless prohibited by

Mississippi, Inc., AutoZone Puerto Rico, Inc., , Inc. and ALLDATA LLC) and any

applicable law, any new or changed terms may at our option be applied to any balance existing in

assignee to which this Agreement is assigned. Your signature on any sales memorandum, purchase

the Account at the time of the change, as well as to any subsequent transactions. No change to

order, sales slip, sales invoice or other or different form (“Sales Memorandum”), any application,

any term of this Agreement will affect your obligation or the obligation of any personal guarantor of

personal guaranty, account setup form, acceptance certificate, or any other document in connection

your Account to pay, in full, all amounts owing under this Agreement or otherwise perform the

with this Account, or your continued use of any software constitutes your signature on this

terms and conditions of this Agreement or any related guaranty.

12. CHANGE OF ADDRESS AND GOVERNING LAW: You agree that initially your principal place

Agreement, as amended from time to time.

of business/billing address is the address to which we sent this Agreement or, if this Agreement

2. ACCOUNT FOR COMMERCIAL PURPOSES ONLY: This Account is established solely for

business, commercial or organizational purposes on behalf of your business. You warrant,

was originally attached to an Application, the address specified in that Application. You agree to

represent and agree that you will not use this Account (or allow this Account to be used) for

notify us promptly if you change this address. Until we receive notice of a new address, we may

personal, family, household or agricultural (collectively, “consumer”) purposes.

You

continue to send billing statements or invoices and other correspondence to the address shown on

understand and agree that this Agreement is not intended to be subject to state and federal laws

our records.

You agree that the terms of this Agreement and any disputes arising in

governing consumer transactions.

You also understand and agree that we will be unable to

connection herewith will be governed and construed under the laws of the State of

determine whether any given transaction conforms to this Section 2. You agree that a breach by

Tennessee (excluding its choice of law rules), which is the location of AutoZone’s principal

you of the provisions of this Section 2 will not affect our right to (i) enforce your promise to pay all

place of business, and applicable federal law.

amounts owed under this Agreement regardless of the purpose for which any particular transaction

13. PRODUCT WARRANTIES. AutoZone does not provide any warranties other than those

is in fact made or (ii) use any remedy legally available to us, even if that remedy would not have

provided by its suppliers and shall not be held liable for any expressed or implied defective

been available had the Account been established as a consumer account.

product claims.

3. PROMISE TO PAY: You jointly and severally promise to pay all amounts owed under this

14. SECURITY INTEREST: Except in CT, NC, and NY, you grant us a purchase money security

Agreement and for all purchases charged to your Account, including any software license fees, late

interest in all goods charged to your Account until each item purchased is paid for. If you default in

charges and other charges that may be applicable from time to time. You understand and agree

your payment obligation, we may repossess and sell any or all of this collateral and exercise any

that we will be unable to determine whether any particular transaction on your Account was in fact

other rights afforded to us under applicable law. We may file financing statements and/or

authorized by you and/or made for your benefit, and you specifically agree that you will pay for all

materialmen’s or mechanic’s liens against the goods pursuant to applicable law.

transactions made on your Account, whether or not such transactions were in fact duly authorized

15.

SEVERABILITY:

If any provision of this Agreement is invalid or unenforceable under

applicable law, that provision will be considered totally ineffective to that extent, but the remaining

by you or made for your benefit.

Your obligations under this Agreement are absolute and

unconditional.

provisions of this Agreement will not be affected.

4. LATE PAYMENT CHARGE: You agree that your default in paying the amount owing on your

16.

DEFAULT; COLLECTION COSTS; ACCELERATION:

You will be in default under this

Account will damage us, insofar as we will incur expenses associated with having to monitor and

Agreement if any of the following events occur: (i) we do not receive any payment due under this

collect your Account. We may assess a “Late Charge” on the portion of the amount remaining

Agreement, or any related guaranty, when the payment is due, (ii) you violate any other

unpaid, at a rate permitted by applicable law. This amount will be added to your Account balance

obligations, representations or warranties under this Agreement or make any false disclosures in

while your default continues, except that no Late Charges will be imposed in the period during

any application or guaranty executed in connection with this Agreement, (iii) you change your form

which your default is cured by repayment of all amounts owing on your Account.

of business organization or there is a change in control of your business, including without

5. DORMANT ACCOUNT FEE: An account will be considered dormant if it has no activity in a six

limitation a change in voting ownership of 15% or more, (iv) you are insolvent, declare bankruptcy

month period. We may charge a fee of $10.00 per month to offset the costs of maintaining the

or similar proceedings are commenced by or against you, or (v) you die, dissolve or cease to do

account.

business, or (vi) any information you provide is incorrect, incomplete or misleading. If you are in

6.

PAYMENTS; DISPUTED AMOUNTS:

Payments, in good funds, are due at the address

default, we may exercise any or all rights and remedies available under law, equity or as provided

(“Payment Address”) and by the payment due date (“Payment Due Date”) shown on your billing

herein.

In addition to the full amount owed and any allowable court costs, if your Account is

statement. All payments mailed or delivered to us should be to the address shown on your billing

referred to an attorney who is not our salaried employee to collect the amount you owe, you agree

statement or by using the envelope enclosed with your billing statement. Payments received after

to pay our reasonable attorneys’ fees and other costs of collection to the fullest extent permitted

2:00 p.m. on any banking day will be posted to your Account on the next banking day. To the

by applicable law.

extent permitted by applicable law, if we accept any late payment or partial payment, whether

17. EXTENSIONS AND RELEASES: We may agree to extend the due date of any payment due

under this Agreement for any length of time or release any other person or entity liable under this

or not marked as payment in full, that acceptance will not affect the due date of any other

payment due under this Agreement, nor will it act as an extension of time or a waiver or

Agreement without notifying you of this extension or release and without releasing you from any of

satisfaction of any payment or amount then remaining unpaid. It will also not modify any of

your obligations under this Agreement or any related guaranty.

our rights under this Agreement. All written communications concerning disputed amounts,

18. TELEPHONE MONITORING: We treat every customer call confidentially. To ensure that you

including any check or other payment instrument that (i) indicates that the payment

receive accurate and courteous customer service, on occasion your call may be monitored by other

constitutes “payment in full” of the amount owed, (ii) is tendered with other conditions or

employees.

limitations or (iii) is otherwise tendered as full satisfaction of a disputed amount, must be

19. ASSIGNMENT: You may not assign any of your rights or obligations under this Agreement

mailed or delivered to us at the address for billing inquiries shown on your billing statement

without our prior written permission.

We are not required to give you our written permission.

or invoice, not your Payment Address. You agree that we may send your billing statements or

Without your consent or prior notice to you, we may sell or assign, in whole or in part, any or all of

invoices to you at your principal place of business/billing address as shown on our records from

our rights and interests in and under this Agreement and any related guaranties or related

time to time.

documentation.

7.

INVESTIGATION AND REPORTING; INACCURATE INFORMATION:

Your credit and the

20. SPECIAL PAYMENT PLANS: From time to time we may offer you special promotional terms

personal credit of any personal guarantor will be used in making credit decisions. You authorize

(“Special Payment Plans”) that, subject to specified conditions, reduce any applicable charges or

us to investigate your creditworthiness by obtaining credit reports and making other inquiries as

fees under this Agreement or otherwise modify the terms of this Agreement with respect to certain

we deem appropriate. Any individual that has signed an application for commercial credit with us

qualifying purchases. If you use your Account in accordance with the terms of a Special Payment

Plan, you agree (i) to the terms of the Special Payment Plan and (ii) that no formal amendment of

on your behalf and any personal guarantor of your Account authorizes us to investigate his/her

this Agreement will be necessary. The standard provisions of this Agreement apply to any Special

personal credit history by obtaining consumer credit reports and by making direct inquiries of

Payment Plan, unless otherwise provided under the Special Payment Plan offering, and will

businesses where his/her accounts are maintained.

You also agree that we may report your

continue to apply to any and all transactions that are not subject to a Special Payment Plan.

performance under this Agreement to credit bureaus and others who may lawfully receive such

information. Any individual that has signed an application for commercial credit with us on your

21. ENTIRE AGREEMENT: This is the entire agreement between you and us and no oral changes

behalf and any personal guarantor of your Account agrees that in the event that your Account is

can be made.

You acknowledge that no promises have been made to you other than those

not paid as agreed, we may report his/her liability for and the status of your Account to credit

incorporated into the written terms of this Agreement. A fully executed copy or reproduction of this

bureaus and others who may lawfully receive such information. If you, any individual that has

Agreement sent to you by us constitutes an original of the Agreement for evidentiary purposes.

signed an application for commercial credit with us on your behalf, or any personal guarantor of

22. JURY WAIVER: TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE AND YOU WAIVE

your Account believe that we have information about any of you that is inaccurate, or that we have

ANY RIGHT TO A TRIAL BY JURY IN ANY ACTION HEREAFTER BROUGHT AND RELATED IN

reported or may report credit reporting agency information about any of you that is inaccurate,

ANY WAY TO THIS AGREEMENT AND YOUR ACCOUNT, UNDER ANY THEORY OF LAW OR

please notify us of the specific information that any of you believe is inaccurate by writing to us at

EQUITY.

the address on your statement.

8. LIMITING OR TERMINATING YOUR CREDIT: We may advise you of a “Credit Limit” on your

IMPORTANT NOTICES

Account, which we may raise, lower, or cancel at any time, and you promise not to allow the

NOTICE TO THE CUSTOMER: (1) DO NOT SIGN THIS AGREEMENT OR USE YOUR ACCOUNT

outstanding balance of your Account to exceed this Credit Limit. We have the right at any time to

TO APPROVE THIS AGREEMENT BEFORE YOU READ THIS AGREEMENT OR IF THIS

limit or terminate the use of your Account, or to terminate this Agreement as it relates to future

AGREEMENT CONTAINS ANY BLANK SPACES. (2) YOU ARE ENTITLED TO A COMPLETELY

transactions, without giving you advance notice. You may terminate this Agreement at any time,

FILLED IN COPY OF THIS AGREEMENT. KEEP THIS AGREEMENT TO PROTECT YOUR LEGAL

upon 60 days prior advance written notice to us, with respect to future use of the Account. If you

RIGHTS. (3) ANY PERSON USING THE ACCOUNT IS MAKING ALL THE REPRESENTATIONS,

or we terminate this Agreement, you agree to pay the outstanding balance of the Account

AND AGREEING TO ALL THE TERMS, CONTAINED IN THE ABOVE APPLICATION AND

according to the applicable terms of this Agreement and the applicable license agreements or

AGREEMENT.

Sales Memoranda and that all of our rights will continue in full force until all of your obligations are

fully satisfied. You may revoke the Account privileges of any individual authorized to use the

Account by notifying us in writing.

Read by______________________________________________ __

9. UNAUTHORIZED USE: You may be liable for any unauthorized use of your Account until you

notify us in writing at AutoZone Commercial Credit, P.O. Box 10, Memphis, TN 38101, or by calling

Initialed____________

Credit Services at (866) 208-3385, of any loss, theft or unauthorized use.

We may request

reasonable cooperation from you, including written confirmation of any such instance if you notify

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2