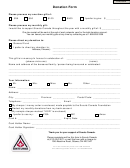

Donation Form Page 2

ADVERTISEMENT

Frequently Asked Questions

The Charitable Tax Credit allows you to direct your tax dollars to

Goodwill of Northern Arizona and receive that amount off your state income tax.

Q: What is the Charitable Tax Credit?

A: The Charitable Tax Credit is a charitable contribution you can give to qualifying Arizona charitable organizations. Goodwill of Northern Arizona is an approved recipient.

You can receive a dollar-for-dollar tax credit on your Arizona state income tax return while helping put people to work - at no additional cost to you. Your gift goes directly

to Goodwill instead of the state.

Q: What is the maximum tax credit I can receive?

A: The limits are $200 for individuals and $400 for married couples filing jointly. However, smaller donations are allowed.

Please consult your tax advisor for more information.

Q: How do I qualify for Charitable Tax Credits?

A: Anyone who pays Arizona state income tax may be eligible for the tax credit. For example, if you are a married couple filing jointly and owe $1000 in state income tax and

you donate $400 to Goodwill, you may subtract $400 from your tax bill and pay the state only $600. Additionally, you can also use the $400 donation as a federal income

tax deduction. Please consult your tax advisor for more information.

Q: Do I have to itemize deductions to claim the credit for contributions to Qualifying Charitable Organizations?

A: No. Starting with the 2013 tax year, you do not have to itemize deductions to claim a credit for contributions to a qualifying charitable organization.

Q: What is the difference between a tax credit and a tax deduction?

A: A tax credit is significantly more beneficial than a tax deduction. A tax credit reduces your tax liability dollar-for-dollar and comes off

at the bottom line. A tax deduction reduces the taxable income upon which your tax liability is calculated.

Q: What is a "qualifying charitable organization?"

A: A qualifying charitable organization is a tax exempt (501)(c)(3) organization or community action agency that allocates at least 50 percent of its budget to services that

help welfare recipients or the working poor with their immediate basic needs. Services, which must be provided and used in Arizona, may include food, clothing, shelter,

cash, health care, child care, job placement and/or job training.

Q: How do I know the organization I support qualifies for the credit under this program?

A: The Arizona Department of Revenue publishes a list of self-certified organizations. To request a list or to see if an organization qualifies,

call the Department of Revenue in Phoenix at (602) 255-3381 or go to

Q: Does the tax credit also apply to my federal income tax return?

A: No. The Charitable Tax Credit applies only to your Arizona state income tax. However, you may be able to claim a federal

tax deduction for the amount donated. Consult your tax advisor for more information.

Q: Can a business make a contribution and claim the tax credit?

A: No. Only individual taxpayers may claim this tax credit.

Q: Can Charitable Tax Credit dollars be refunded or can unused amounts be carried forward?

A: Charitable Tax Credit dollars cannot be refunded. They can only be used to reduce your state tax liability to zero.

Any unused dollars may be carried forward for up to the next five taxable years.

Q: Can I make contributions to more than one qualifying charitable organization?

A: Yes, but the total Charitable Tax Credit allowed is $200 per individual or $400 for married couples filing jointly, regardless of the number of organizations you support.

Q: Can I take the Charitable Tax Credit if I take the Public School Tax Credit and/or the Private Tuition Organization Charitable Tax Credit?

A: Yes, they are separate credits and you are allowed to take advantage of all three charitable contributions.

Q: Can I donate food, clothing or services to a qualifying charitable organization and claim the tax credit for those donations?

A: No. Only cash contributions qualify for the Charitable Tax Credit.

Q: Can my charitable donation be made through payroll deductions?

A: Yes. You can make cash contributions through payroll deductions towards one or more qualifying charitable organizations.

Please consult your employer to set up your payroll deduction using Arizona Form A-4C.

Q: Where can I get more information about the tax credit?

A: You can get more information by visiting the Arizona Department of Revenue website at or by calling Taxpayer Assistance at (602) 255-3381.

Q: Will I receive acknowledgement for my tax credit donation?

A: Yes, Goodwill of Northern Arizona will send you written acknowledgement for your donation in a timely manner that can be used for

your Arizona and IRS tax returns. Goodwill Industries of Northern Arizona’s Tax ID is 86-00280491. Please call (928) 526-9188 for further information.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2