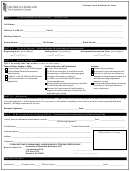

Deferment Form Page 2

ADVERTISEMENT

INSTRUCTIONS

Section 1 – Choose one of the following deferment types:

A.

At least Half-time Student (Federal Perkins and NC State University Institutional Loans) - To receive an in-

school deferment, the borrower must be enrolled as a regular student in an eligible institution of higher education

or a comparable institution outside the United States approved by the Department for deferment purposes. A

regular student is one who is enrolled for the purpose of obtaining a degree or certificate. Half-time is usually

defined as at least 6 credit per semester for undergraduates and at least 3 credits per semester for graduate

students.

B.

Internship or Residency or Advanced Professional Training (Federal Perkins Loans and NC State

University Institutional Loans) - Only loans received prior to 7/1/1993 are eligible for intern or residency

deferment.

C.

Volunteer in the Peace Corps (NC State University Institutional Loans) - Borrowers who volunteer under the

Peace Corps Act are eligible for deferment for up to three years. Such service performed during the grace period

does not count as part of the maximum deferment period for which the borrower is eligible, nor does it entitle the

borrower to a grace period after the deferment period ends.

D.

Graduate / Fellowship (Federal Perkins and NC State University Institutional Loans) - A borrower enrolled

and in attendance as a regular student in a course of study that is part of a graduate fellowship program approved

by the Department may defer payments. A borrower is engaged in graduate or postgraduate fellowship-supported

study such as a Fulbright grant outside the United States.

E.

Rehabilitation Training Program for Disabled Individuals (Federal Perkins and NC State Institutional

Loans) – A borrower may defer repayment if he or she is enrolled in a course of study that is part of a

Department-approved rehabilitation-training program for disabled individuals. To receive this deferment, the

borrower must provide the school with certification that: • the borrower is receiving, or scheduled to receive,

rehabilitation training from the agency; • the agency is licensed, approved, certified, or otherwise recognized by a

State agency responsible for programs in vocational rehabilitation, drug abuse treatment, mental health services,

or alcohol abuse treatment; or by the Department of Veterans Affairs; and • the agency provides or will provide

the borrower rehabilitation services under a written plan that (1) is individualized to meet the borrower’s needs; (2)

specifies the date that services will end; (3) is structured in a way that requires substantial commitment from the

borrower. A substantial commitment from the borrower is a commitment of time and effort that would normally

prevent the borrower from holding a full-time job either because of the number of hours that must be devoted to

rehabilitation or because of the nature of the rehabilitation.

F.

Active Duty in support of a current military contingency operation (Federal Perkins and NC State

University Institutional Loans made after 7/1/2001) - Active duty in support or connection with a war or other

military operation or national emergency or performing qualifying National Guard duty during a war or other

military operation or national emergency. A copy of the borrower’s military orders must be submitted with

the deferment form.

Section 2 – Enter the dates for which you are requesting a deferment. Please note that deferments are granted for a 12-

month period only. Borrowers will need to reapply for subsequent periods for which they are eligible for a deferment.

Section 3 – The borrower must sign and date the deferment form.

Section 4 – The deferment form must be signed and certified by the School/Agency/Institution Official who is able to

verify the validity of the deferment the borrower is requesting.

Submit Form:

Mail: ECSI, 181 Montour Run Road, Caraopolis, PA 15108

Fax: (866) 291-5384

E-mail: cservice@ecsi.net

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2