Social Club Reimbursement Form Page 4

ADVERTISEMENT

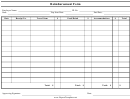

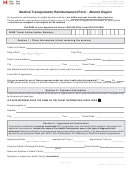

This Page for Business Service Center Use Only:

Employee Name:

Club:

Reimbursement Period (Month/Year):

5

A

Fully Substantiated Business Expenses

6

B

Partially Substantiated Business Expenses

C

Annual Charges

D

Dues

E

Days with Fully Substantiated Business Expenses

7

F

Total Days Used

G

Fully Substantiated Dues: [D*E/F]

7

H

Fully Substantiated Annual Charges [C*Annual Percent]

I

Accountable Plan Reimbursement Amount

0.00

[A+G+H]

J

Nonaccountable Plan Reimbursement Amount [B]

5

Include only expenses for which all fields of the Business Expense Log are adequately completed and correspond to submitted receipts or the club monthly

statement. Do not include any expenses incurred in connection with influencing legislation, participation in any political campaign, attempts to influence the

general public with respect to elections or legislation, or any direct communication with a covered executive branch official in an attempt to influence the official

actions or positions of such official.

6

Include only expenses which would qualify as Fully Substantiated Business Expenses but for the fact that the “Guest Occupational Information” field is

completed with a general description rather than the required specificity per the Regulations of the University of North Texas System.

7

Include all days that included expenses marked “B” or “P” on the club monthly statement (not including food minimum charges) plus any days listed on Page 1

of the Club Reimbursement Form.

7

Use prior reimbursement forms to determine the Annual Percent, which is the number of days the club was used for Fully Substantiated Business Expenses

divided by the total days of club use for the entire period to which the change relates (e.g., one year for a true annual charge).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4