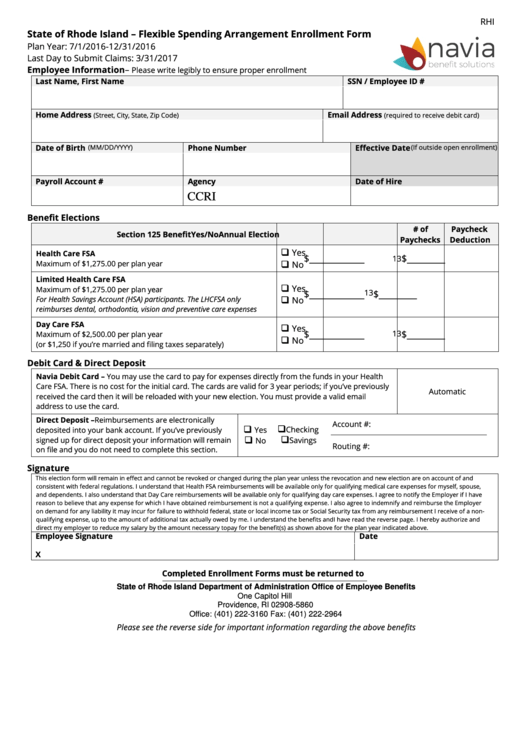

RHI

State of Rhode Island – Flexible Spending Arrangement Enrollment Form

Plan Year: 7/1/2016-12/31/2016

Last Day to Submit Claims: 3/31/2017

Employee Information –

Please write legibly to ensure proper enrollment

Last Name, First Name

SSN / Employee ID #

Home Address

Email Address

(Street, City, State, Zip Code)

(required to receive debit card)

Date of Birth

Phone Number

Effective Date

(MM/DD/YYYY)

(If outside open enrollment)

Payroll Account #

Agency

Date of Hire

CCRI

Benefit Elections

# of

Paycheck

Section 125 Benefit

Yes/No

Annual Election

Paychecks

Deduction

Yes

Health Care FSA

$_____________

$_________

13

Maximum of $1,275.00 per plan year

No

Limited Health Care FSA

Yes

Maximum of $1,275.00 per plan year

13

$_____________

$_________

For Health Savings Account (HSA) participants. The LHCFSA only

No

reimburses dental, orthodontia, vision and preventive care expenses

Day Care FSA

Yes

$_____________

13

$_________

Maximum of $2,500.00 per plan year

No

(or $1,250 if you’re married and filing taxes separately)

Debit Card & Direct Deposit

Navia Debit Card – You may use the card to pay for expenses directly from the funds in your Health

Care FSA. There is no cost for the initial card. The cards are valid for 3 year periods; if you’ve previously

Automatic

received the card then it will be reloaded with your new election. You must provide a valid email

address to use the card.

Direct Deposit – Reimbursements are electronically

Account #:

Yes

Checking

deposited into your bank account. If you’ve previously

signed up for direct deposit your information will remain

No

Savings

Routing #:

on file and you do not need to complete this section.

Signature

This election form will remain in effect and cannot be revoked or changed during the plan year unless the revocation and new election are on account of and

consistent with federal regulations. I understand that Health FSA reimbursements will be available only for qualifying medical care expenses for myself, spouse,

and dependents. I also understand that Day Care reimbursements will be available only for qualifying day care expenses. I agree to notify the Employer if I have

reason to believe that any expense for which I have obtained reimbursement is not a qualifying expense. I also agree to indemnify and reimburse the Employer

on demand for any liability it may incur for failure to withhold federal, state or local income tax or Social Security tax from any reimbursement I receive of a non-

qualifying expense, up to the amount of additional tax actually owed by me. I understand the benefits and I have read the reverse page. I hereby authorize and

direct my employer to reduce my salary by the amount necessary to pay for the benefit(s) as shown above for the plan year indicated above.

Employee Signature

Date

X

Completed Enrollment Forms must be returned to

State of Rhode Island Department of Administration Office of Employee Benefits

One Capitol Hill

Providence, RI 02908-5860

Office: (401) 222-3160 Fax: (401) 222-2964

Please see the reverse side for important information regarding the above benefits

1

1 2

2