Residency Checklist - Ventura College

ADVERTISEMENT

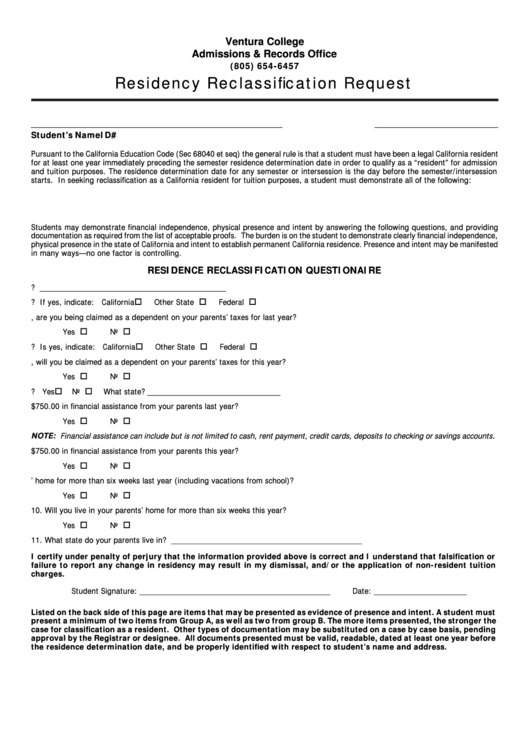

Ventura College

Admissions & Records Office

(805) 654-6457

Residency Reclassification Request

_____________________________________________________

__________________________

Student’s Name

ID#

Pursuant to the California Education Code (Sec 68040 et seq) the general rule is that a student must have been a legal California resident

for at least one year immediately preceding the semester residence determination date in order to qualify as a “resident” for admission

and tuition purposes. The residence determination date for any semester or intersession is the day before the semester/intersession

starts. In seeking reclassification as a California resident for tuition purposes, a student must demonstrate all of the following:

1. Financial independence.

2. Living in California for at least one year and one day prior to the beginning of the term for which reclassification is requested.

3. Establishing intent to become a permanent California resident.

Students may demonstrate financial independence, physical presence and intent by answering the following questions, and providing

documentation as required from the list of acceptable proofs. The burden is on the student to demonstrate clearly financial independence,

physical presence in the state of California and intent to establish permanent California residence. Presence and intent may be manifested

in many ways—no one factor is controlling.

RESIDENCE RECLASSIFICATION QUESTIONAIRE

1. When did you arrive in California with the intent to become a resident? __________________________________________

2. Did you file your own taxes last year? If yes, indicate: California

Other State

Federal

3. If you did not file your own taxes last year, are you being claimed as a dependent on your parents’ taxes for last year?

Yes

No

4. Will you file your own taxes this year? Is yes, indicate: California

Other State

Federal

5. If you will not file your own taxes this year, will you be claimed as a dependent on your parents’ taxes for this year?

Yes

No

6. Do your parents file taxes in a state other than California? Yes

No

What state? ______________________________

7. Did you receive more than $750.00 in financial assistance from your parents last year?

Yes

No

NOTE: Financial assistance can include but is not limited to cash, rent payment, credit cards, deposits to checking or savings accounts.

8. Will you receive more than $750.00 in financial assistance from your parents this year?

Yes

No

9. Did you live in your parents’ home for more than six weeks last year (including vacations from school)?

Yes

No

10. Will you live in your parents’ home for more than six weeks this year?

Yes

No

11. What state do your parents live in? ___________________________________________

I certify under penalty of perjury that the information provided above is correct and I understand that falsification or

failure to report any change in residency may result in my dismissal, and/or the application of non-resident tuition

charges.

Student Signature: ___________________________________________

Date: _____________________

Listed on the back side of this page are items that may be presented as evidence of presence and intent. A student must

present a minimum of two items from Group A, as well as two from group B. The more items presented, the stronger the

case for classification as a resident. Other types of documentation may be substituted on a case by case basis, pending

approval by the Registrar or designee. All documents presented must be valid, readable, dated at least one year before

the residence determination date, and be properly identified with respect to student’s name and address.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2