Gift In Kind Donation Form - Exceptional Persons

ADVERTISEMENT

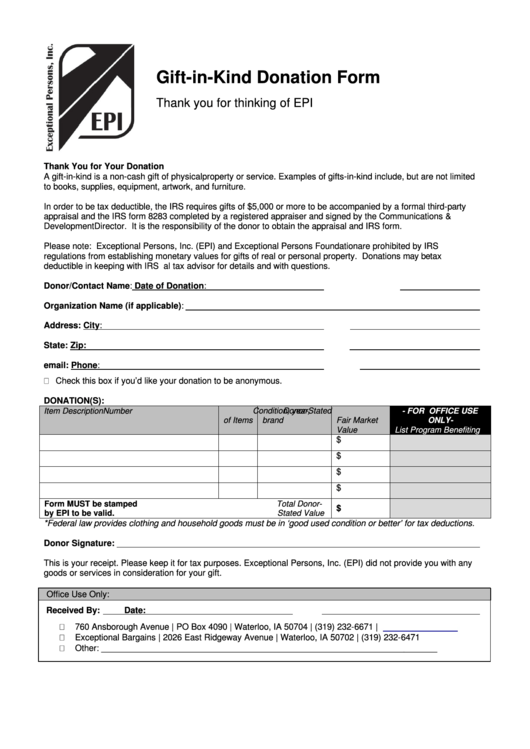

Gift-in-Kind Donation Form

Thank you for thinking of EPI

Thank You for Your Donation

A gift-in-kind is a non-cash gift of physical property or service. Examples of gifts-in-kind include, but are not limited

to books, supplies, equipment, artwork, and furniture.

In order to be tax deductible, the IRS requires gifts of $5,000 or more to be accompanied by a formal third-party

appraisal and the IRS form 8283 completed by a registered appraiser and signed by the Communications &

Development Director. It is the responsibility of the donor to obtain the appraisal and IRS form.

Please note: Exceptional Persons, Inc. (EPI) and Exceptional Persons Foundation are prohibited by IRS

regulations from establishing monetary values for gifts of real or personal property. Donations may be tax

deductible in keeping with IRS regulations. Please consult your personal tax advisor for details and with questions.

Donor/Contact Name:

Date of Donation:

Organization Name (if applicable):

Address:

City:

State:

Zip:

email:

Phone:

Check this box if you’d like your donation to be anonymous.

DONATION(S):

Item Description

Number

Condition, year,

Donor-Stated

- FOR OFFICE USE

of Items

brand

Fair Market

ONLY-

Value

List Program Benefiting

$

$

$

$

Form MUST be stamped

Total Donor-

$

by EPI to be valid.

Stated Value

*Federal law provides clothing and household goods must be in ‘good used condition or better’ for tax deductions.

Donor Signature:

This is your receipt. Please keep it for tax purposes. Exceptional Persons, Inc. (EPI) did not provide you with any

goods or services in consideration for your gift.

Office Use Only:

Received By:

Date:

760 Ansborough Avenue | PO Box 4090 | Waterloo, IA 50704 | (319) 232-6671 |

Exceptional Bargains | 2026 East Ridgeway Avenue | Waterloo, IA 50702 | (319) 232-6471

Other: _______________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1