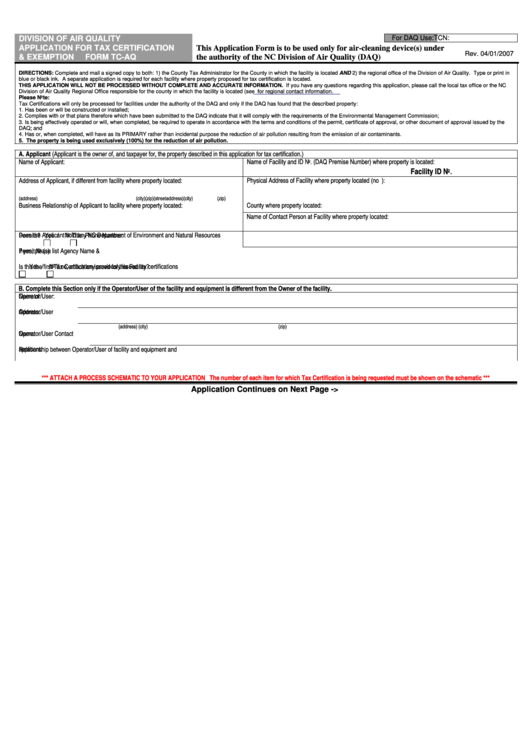

Division Of Air Quality Application For Tax Certification

ADVERTISEMENT

For DAQ Use:

TCN:

DIVISION OF AIR QUALITY

APPLICATION FOR TAX CERTIFICATION

This Application Form is to be used only for air-cleaning device(s) under

Rev. 04/01/2007

& EXEMPTION

FORM TC-AQ

the authority of the NC Division of Air Quality (DAQ)

DIRECTIONS: Complete and mail a signed copy to both: 1) the County Tax Administrator for the County in which the facility is located AND 2) the regional office of the Division of Air Quality. Type or print in

blue or black ink. A separate application is required for each facility where property proposed for tax certification is located.

THIS APPLICATION WILL NOT BE PROCESSED WITHOUT COMPLETE AND ACCURATE INFORMATION. If you have any questions regarding this application, please call the local tax office or the NC

Division of Air Quality Regional Office responsible for the county in which the facility is located (see

for regional contact information.

Please Note:

Tax Certifications will only be processed for facilities under the authority of the DAQ and only if the DAQ has found that the described property:

1. Has been or will be constructed or installed;

2. Complies with or that plans therefore which have been submitted to the DAQ indicate that it will comply with the requirements of the Environmental Management Commission;

3. Is being effectively operated or will, when completed, be required to operate in accordance with the terms and conditions of the permit, certificate of approval, or other document of approval issued by the

DAQ; and

4. Has or, when completed, will have as its PRIMARY rather than incidental purpose the reduction of air pollution resulting from the emission of air contaminants.

5. The property is being used exclusively (100%) for the reduction of air pollution.

A. Applicant (Applicant is the owner of, and taxpayer for, the property described in this application for tax certification.)

Name of Applicant:

Name of Facility and ID No. (DAQ Premise Number) where property is located:

.

Facility ID No

Address of Applicant, if different from facility where property located:

Physical Address of Facility where property located (no P.O. Box):

(address)

(city)

(zip)

(street address)

(city)

(zip)

Business Relationship of Applicant to facility where property located:

County where property located:

Name of Contact Person at Facility where property located:

Does the Applicant hold any NC Department of Environment and Natural Resources

Permits?

Yes /

No

Title:

Phone Number:

If yes, please list Agency Name &

Permit No (s):

Is this the first Tax Certification issued for this Facility?

Yes /

No

If no, attach any previously issued tax certifications

B. Complete this Section only if the Operator/User of the facility and equipment is different from the Owner of the facility.

Name of

Operator/User:

Operator/User

Address:

(address)

(city)

(zip)

Operator/User Contact

Name:

Relationship between Operator/User of facility and equipment and

applicant:

*** ATTACH A PROCESS SCHEMATIC TO YOUR APPLICATION The number of each item for which Tax Certification is being requested must be shown on the schematic ***

Application Continues on Next Page ->

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3