Update Of Personal Particulars Form (Individual)

ADVERTISEMENT

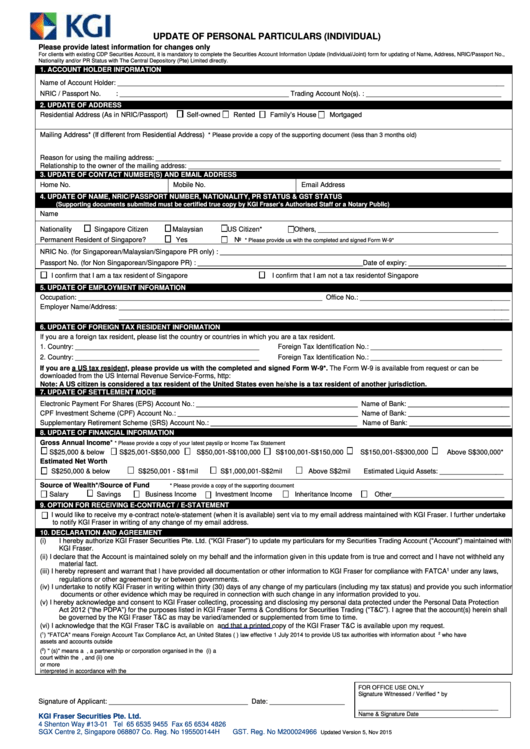

UPDATE OF PERSONAL PARTICULARS (INDIVIDUAL)

Please provide latest information for changes only

For clients with existing CDP Securities Account, it is mandatory to complete the Securities Account Information Update (Individual/Joint) form for updating of Name, Address, NRIC/Passport No.,

Nationality and/or PR Status with The Central Depository (Pte) Limited directly.

1.

ACCOUNT HOLDER INFORMATION

Name of Account Holder: _______________________________________________________________________________________________________

NRIC / Passport No.

: _____________________________________________ Trading Account No(s). : ____________________________________

2.

UPDATE OF ADDRESS

Rented

Family’s House

Mortgaged

Residential Address (As in NRIC/Passport)

Self-owned

Mailing Address* (If different from Residential Address)

* Please provide a copy of the supporting document (less than 3 months old)

Reason for using the mailing address: ____________________________________________________________________________________________

Relationship to the owner of the mailing address: ___________________________________________________________________________________

3.

UPDATE OF CONTACT NUMBER(S) AND EMAIL ADDRESS

Home No.

Mobile No.

Email Address

4.

UPDATE OF NAME, NRIC/PASSPORT NUMBER, NATIONALITY, PR STATUS & GST STATUS

(Supporting documents submitted must be certified true copy by KGI Fraser’s Authorised Staff or a Notary Public)

Name

Nationality

Singapore Citizen

Malaysian

US Citizen*

Others, ________________________________________________

Permanent Resident of Singapore?

Yes

No

* Please provide us with the completed and signed Form W-9*

NRIC No. (for Singaporean/Malaysian/Singapore PR only) : ______________________________________________________________________________

Passport No. (for Non Singaporean/Singapore PR) : ____________________________________________ Date of expiry: __________________________

I confirm that I am a tax resident of Singapore

I confirm that I am not a tax resident of Singapore

5. UPDATE OF EMPLOYMENT INFORMATION

Occupation: _________________________________________________________________ Office No.: ________________________________________

Employer Name/Address: ________________________________________________________________________________________________________

________________________________________________________________________________________________________

6. UPDATE OF FOREIGN TAX RESIDENT INFORMATION

If you are a foreign tax resident, please list the country or countries in which you are a tax resident.

1.

Country: _________________________________________________

Foreign Tax Identification No.: ___________________________________

2.

Country: _________________________________________________

Foreign Tax Identification No.: ___________________________________

If you are a US tax resident, please provide us with the completed and signed Form W-9*. The Form W-9 is available from request or can be

downloaded from the US Internal Revenue Service-Forms, http:

Note: A US citizen is considered a tax resident of the United States even he/she is a tax resident of another jurisdiction.

7.

UPDATE OF SETTLEMENT MODE

Electronic Payment For Shares (EPS) Account No.: ___________________________________________ Name of Bank: ___________________________

CPF Investment Scheme (CPF) Account No.: ________________________________________________ Name of Bank: ___________________________

Supplementary Retirement Scheme (SRS) Account No.: _______________________________________ Name of Bank: ___________________________

8.

UPDATE OF FINANCIAL INFORMATION

Gross Annual Income*

* Please provide a copy of your latest payslip or Income Tax Statement

S$25,000 & below

S$25,001-S$50,000

S$50,001-S$100,000

S$100,001-S$150,000

S$150,001-S$300,000

Above S$300,000*

Estimated Net Worth

S$250,000 & below

S$250,001 - S$1mil

S$1,000,001-S$2mil

Above S$2mil

Estimated Liquid Assets: _________________

Source of Wealth*/Source of Fund

* Please provide a copy of the supporting document

Salary

Savings

Business Income

Investment Income

Inheritance Income

Other______________________________

9.

OPTION FOR RECEIVING E-CONTRACT / E-STATEMENT

I would like to receive my e-contract note/e-statement (when it is available) sent via to my email address maintained with KGI Fraser. I further undertake

to notify KGI Fraser in writing of any change of my email address.

10. DECLARATION AND AGREEMENT

I hereby authorize KGI Fraser Securities Pte. Ltd. (“KGI Fraser”) to update my particulars for my Securities Trading Account (“Account”) maintained with

(i)

KGI Fraser.

(ii)

I declare that the Account is maintained solely on my behalf and the information given in this update from is true and correct and I have not withheld any

material fact.

1

(iii)

I hereby represent and warrant that I have provided all documentation or other information to KGI Fraser for compliance with FATCA

under any laws,

regulations or other agreement by or between governments.

(iv)

I undertake to notify KGI Fraser in writing within thirty (30) days of any change of my particulars (including my tax status) and provide you such information,

documents or other evidence which may be required in connection with such change in any information provided to you.

(v)

I hereby acknowledge and consent to KGI Fraser collecting, processing and disclosing my personal data protected under the Personal Data Protection

Act 2012 (“the PDPA”) for the purposes listed in KGI Fraser Terms & Conditions for Securities Trading (“T&C”). I agree that the account(s) herein shall

be governed by the KGI Fraser T&C as may be varied/amended or supplemented from time to time.

(vi)

I acknowledge that the KGI Fraser T&C is available on

and that a printed copy of the KGI Fraser T&C is available upon my request.

1

2

(

) "FATCA" means Foreign Account Tax Compliance Act, an United States (U.S.) law effective 1 July 2014 to provide US tax authorities with information about U.S. Persons

who have

assets and accounts outside U.S.

2

(

) "U.S. Person(s)" means a U.S. Citizen or resident individual, a partnership or corporation organised in the U.S. or under the laws of the U.S. or any State of the U.S. or a trust if (i) a

court within the U.S. would have authority under applicable law to render orders or judgements concerning substantially all issues regarding the administration of the trust, and (ii) one

or more U.S. Persons have the authority to control all substantial decisions of the trust or an estate of a descendent that is a citizen or resident of the U.S. This definition shall be

interpreted in accordance with the U.S. Internal Revenue Code.

FOR OFFICE USE ONLY

Signature Witnessed / Verified * by

Signature of Applicant: _____________________________________ Date: ____________________

___________________________

________________

Name & Signature

Date

KGI Fraser Securities Pte. Ltd.

4 Shenton Way #13-01

Tel 65 6535 9455

Fax 65 6534 4826

SGX Centre 2, Singapore 068807

Co. Reg. No 195500144H

GST. Reg. No M200024966

Updated Version 5, Nov 2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1