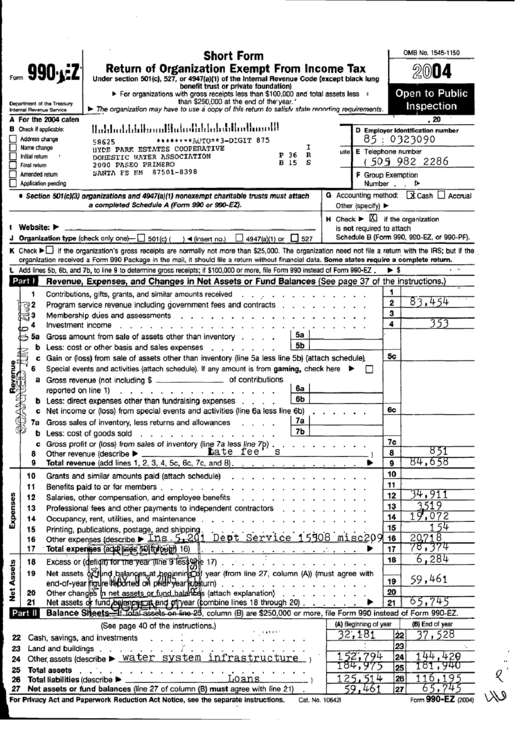

Short Form Return Of Organization Exempt From Income Tax

ADVERTISEMENT

Short Form

Return of Organization Exempt From Income Tax

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung

benefit trust or private foundation)

For organizations with gross receipts less than $100,000 and total assets less

Department

ol

ma Treasury

than $250,000 at the end of the' year.'

Internal Revenue Service

" The organization may have to use a copy of this return to satisiv state raonrnng requirement;

A For the 2004 calen

S

fit

20

B Check i12PP11C2bIB:

I/117fi1S1i1I 1111I :I1EiSlEllii{I1lif ;t71l1 fitS'E11191111711 1

D Employer Identification number

0 Address change

55 8 6 2 5

*****'<*T ;0Tp'`*3_DIGIT 875

85 :

0323090

Name change

(lYDT' PARK ESTATES COOPERATIVE

initial return

~

DOMESTIC WATER ASSOCIATION

p 36

R

uite E Telephone number

0 Final return

2000 PASEO PRIb1ER0

B 15

S

(50

5 982 2286

F1 Amended return

SANTA Fr rrM

r37501-8398

F Group Exemption

0 Application pending

Number

G Accounting method:

[R Cash El Accrual

Other (specify)

H Check " M if the organization

~ Section SD1(c)(3) organizations and 4947(a)(1) nonexempt charitable trusts must attach

a completed Schedule A (Form 990 or 990-EZ).

I Website : "

I

is not required to attach

J Organization type (check only ones- 0 501 (c) (

) " (insert no .)

D 4947(a)(1) or Ej 527

Schedule B (Form 990, 90 . 0-EZ, or 990-PF).

K Check Iii-El if the organization's gross receipts are normally not more than $25,000. The organization need not file a return with the IRS; but if the

organization received a Form 990 Package in the mail, it should file a return without financial data. Some states require a complete return .

L Add lines Sb, 6b, and 7b, to line 9 to determine gross receipts; if $100,000 or more, file Form 990 instead of Form 990-EZ .

" $

Revenue Expenses, and Chan ges in Net Assets or Fund Balances See a e 37 of the instructions.)

1

Contributions, gifts, grants, and similar amounts received

.

.

1 2

Program service revenue including government fees and contracts

3

Membership dues and assessments

4

Investment income

,

.

.

.

,

.

.

.

. .

.

.

.

.

.

'

.

.

5a Gross amount from sale of assets other than inventory .

.

.

,

5a

b Less: cost or other basis and sales expenses

.

.

.

.

,

,

,

5b

c Gain or (loss) from sale of assets other than inventory (line 5a less line 5b) (attach schedule

6

Special events and activities (attach schedule). If any amount is from gaming, check here "

0

> ~

a Gross revenue (not including $

of contributions

cc, ~j

reported on line 1)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

,

,

6a

b Less: direct expenses other than fundraising expenses .

.

.

,

6b

c Net income or (loss) from special events and activities (line 6a less line 6b)

.

,

~~ 7a Gross sales of inventory, less returns and allowances

b Less: cost of goods sold

.

.

.

.

c Gross profit or (loss) from sales of inventory (line 7a less line 7b) .

8

Other revenue (describe ~

date fee '

S

~

~

~

~

~

~ ~ ~ ~

g

851

, b ~t3

9

Total revenue (add lines 1, 2, 3, 4, 5c, 6c, 7c, and 8) .

,

"

9

6 4

10

Grants and similar amounts paid (attach schedule)

.

,

.

.

.

,

.

.

.

.

,

.

,

,

10

11

Benefits paid to or for members .

.

.

.

,

,

1

12

Salaries, other compensation, and employee benefits

,

.

.

.

.

.

.

.

.

.

. . ,

12

3 4 ,91

c

13

Professional fees and other payments to independent contractors

.

13

19

14

Occupancy, rent, utilities, and maintenance ,

.

.

.

,

.

.

.

.

.

.

.

.

.

, ,

,

14

1 91, 072

15

Printing, publications, postage, and shippin ,

,

.

. .

,

15

1

16

Other expenses describe- "

riS- .- ---

~De .tService

O8 m1SC2Q

16

20,718

17 ' Total expe

es a

-

~`

16)

"

17

18

Excess or( efi

h` e

es

' 17) .

.

.

,

.'

19

Net assets ~f n b I n

t ~,Q rn

year (from line 27, column (A)) (must agree with

19

59 , 46 1

end-of-year '

rerte~pki~Wq~ear

urn) .

.

.

.

.

20

Other chan ~

net assets

(attach explanation)

.

.

.

.

.

.

.

.

20

21

Net assets

fund

- n -

ear ( ombine lines 18 through 20) .

.

.

"

21

b5 ,7 45

Balance

IiMW

S qeA -

, column (B) are $250,000 or more, file Form 990 instead of Form 990-EZ .

(See page 40 of the instructions .)

(n) Beginning of year

[s) end of year

28

22 Cash, savings, and investments

.

.

.

:

.

.

.

.

.

.

. ' .

., .

.

,

32' 1 8 1

22

23 Land and buildings .

.

.

.

.

.

.

%' .

,

.

.

.

.

.

.

.

.

23

24 Othe~assets (describe ~ water system infrastructure

~

152~, 794

24

1 44 , 4 22

104

25 Total assets .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

,

,

.

~

25

1 ~1 , y'~U

26 Total liabilities (describe "

~ LOariS

~

12

4

26

11 6, 1 95

27 Net assets or fund balances line 27 of column B must a ree with line 21

1

27

s

` \\ c~

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions .

Cat. No . 106421

Form 990-EZ (2004)

OMB No . 1545-1150

2004

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2