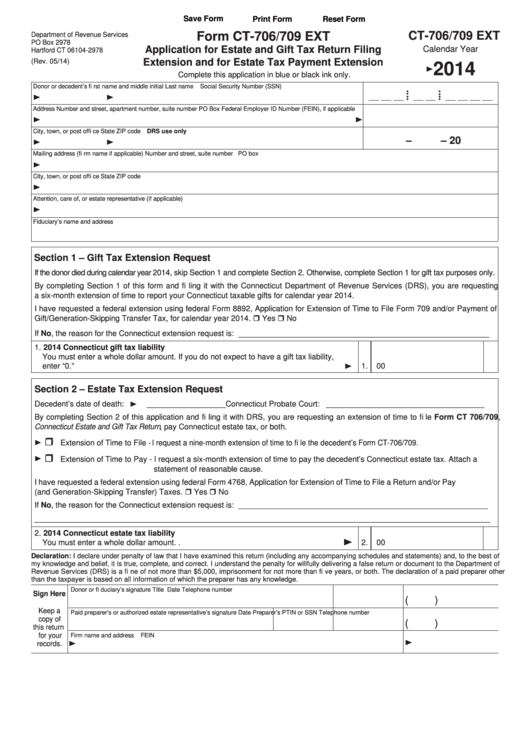

Save Form

Reset Form

Print Form

Form CT-706/709 EXT

CT-706/709 EXT

Department of Revenue Services

PO Box 2978

Application for Estate and Gift Tax Return Filing

Calendar Year

Hartford CT 06104-2978

Extension and for Estate Tax Payment Extension

(Rev. 05/14)

2014

Complete this application in blue or black ink only.

Donor or decedent’s fi rst name and middle initial

Last name

Social Security Number (SSN)

• •

• •

__ __ __

• •

• •

__ __

__ __ __ __

Address

Number and street, apartment number, suite number

PO Box

Federal Employer ID Number (FEIN), if applicable

City, town, or post offi ce

State

ZIP code

DRS use only

–

– 20

Mailing address (fi rm name if applicable)

Number and street, suite number

PO box

City, town, or post offi ce

State

ZIP code

Attention, care of, or estate representative (if applicable)

Fiduciary’s name and address

Section 1 – Gift Tax Extension Request

If the donor died during calendar year 2014, skip Section 1 and complete Section 2. Otherwise, complete Section 1 for gift tax purposes only.

By completing Section 1 of this form and fi ling it with the Connecticut Department of Revenue Services (DRS), you are requesting

a six-month extension of time to report your Connecticut taxable gifts for calendar year 2014.

I have requested a federal extension using federal Form 8892, Application for Extension of Time to File Form 709 and/or Payment of

Yes

No

Gift/Generation-Skipping Transfer Tax, for calendar year 2014.

_________________________________________________

If No, the reason for the Connecticut extension request is:

1. 2014 Connecticut gift tax liability

You must enter a whole dollar amount. If you do not expect to have a gift tax liability,

enter “0.” ...........................................................................................................................

1.

00

Section 2 – Estate Tax Extension Request

__________________ Connecticut Probate Court: ____________________________________

Decedent’s date of death:

By completing Section 2 of this application and fi ling it with DRS, you are requesting an extension of time to fi le Form CT 706/709,

Connecticut Estate and Gift Tax Return, pay Connecticut estate tax, or both.

Extension of Time to File - I request a nine-month extension of time to fi le the decedent’s Form CT-706/709.

Extension of Time to Pay - I request a six-month extension of time to pay the decedent’s Connecticut estate tax. Attach a

statement of reasonable cause.

I have requested a federal extension using federal Form 4768, Application for Extension of Time to File a Return and/or Pay U.S. Estate

Yes

No

(and Generation-Skipping Transfer) Taxes.

If No, the reason for the Connecticut extension request is: _________________________________________________________

________________________________________________________________________________________________________

2. 2014 Connecticut estate tax liability

You must enter a whole dollar amount. . ..........................................................................

2.

00

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department of

Revenue Services (DRS) is a fi ne of not more than $5,000, imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other

than the taxpayer is based on all information of which the preparer has any knowledge.

Donor or fi duciary’s signature

Title

Date

Telephone number

Sign Here

(

)

Keep a

Paid preparer’s or authorized estate representative’s signature

Date

Preparer’s PTIN or SSN Telephone number

copy of

(

)

this return

for your

Firm name and address

FEIN

records.

1

1 2

2