Town Of Star City Privilege Tax Return

ADVERTISEMENT

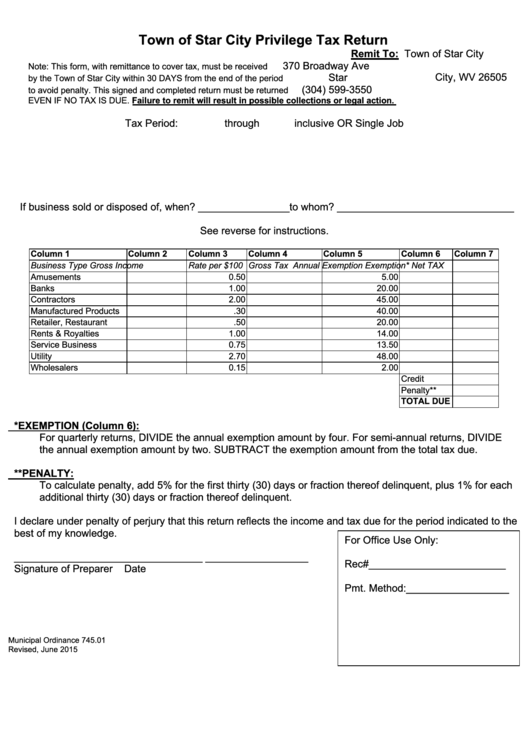

Town of Star City Privilege Tax Return

Town of Star City

Remit To:

370 Broadway Ave

Note: This form, with remittance to cover tax, must be received

Star City, WV 26505

by the Town of Star City within 30 DAYS from the end of the period

(304) 599-3550

to avoid penalty. This signed and completed return must be returned

EVEN IF NO TAX IS DUE. Failure to remit will result in possible collections or legal action.

Tax Period:

through

inclusive OR Single Job

If business sold or disposed of, when? ________________to whom? _______________________________

See reverse for instructions.

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Column 7

Business Type

Gross Income Rate per $100 Gross Tax

Annual Exemption Exemption*

Net TAX

Amusements

0.50

5.00

Banks

1.00

20.00

Contractors

2.00

45.00

Manufactured Products

.30

40.00

Retailer, Restaurant

.50

20.00

Rents & Royalties

1.00

14.00

Service Business

0.75

13.50

Utility

2.70

48.00

Wholesalers

0.15

2.00

Credit

Penalty**

TOTAL DUE

*EXEMPTION (Column 6):

For quarterly returns, DIVIDE the annual exemption amount by four. For semi-annual returns, DIVIDE

the annual exemption amount by two. SUBTRACT the exemption amount from the total tax due.

**PENALTY:

To calculate penalty, add 5% for the first thirty (30) days or fraction thereof delinquent, plus 1% for each

additional thirty (30) days or fraction thereof delinquent.

I declare under penalty of perjury that this return reflects the income and tax due for the period indicated to the

best of my knowledge.

For Office Use Only:

_________________________________

__________________

Rec#________________________

Signature of Preparer

Date

Pmt. Method:__________________

Municipal Ordinance 745.01

Revised, June 2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2