Page 2 of 4

1.

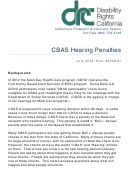

How Will The CBAS Hearing Penalty Check Affect My

Medi-Cal?

Your Medi-Cal will not be affected by a CBAS hearing penalty check.

Under the provisions of the Ball v. Swoap lawsuit the penalty check

amount cannot be counted as income or a resource under the Medi-Cal

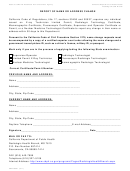

program. If you do not receive SSI, you must report the check to the

county department that determines your Medi-Cal eligibility. Notices

from DHCS and the California Department of Aging (CDA) tell you to use

the Medi-Cal Status Report Form (MC176S) to report the check, and

write that the money is a "Ball Payment." See attachment 1 and

9.pdf

for Form MC176S. See attachments 2 and 3 for DHCS and CDA

notices. You must report the check within 10 days after you receive it.

If you receive SSI, also report the check to the Social Security

Administration (SSA). (SSA is the agency in charge of Medi-Cal

i

eligibility for people who get SSI.)See Question 3.

2.

How Will the CBAS Hearing Penalty Check Affect My

Medicare?

Medicare benefits will not be affected by a CBAS hearing penalty

check.

3.

How Will The CBAS Hearing Penalty Check Affect My

SSI?

Your SSI may be affected by the CBAS penalty check. Disability Rights

California is researching whether or not the same rules that apply to

Medi-Cal apply to SSI. In any event, you must report the CBAS hearing

penalty check to SSA as soon as you get it, but no later than the 10th

day of the month after the month you get it. So for example, if you get

the check in July 2013, you must report it by August 10, 2013. In

addition, it is important that you include a copy of the notices from DHCS

and CDA when you report the CBAS hearing penalty check to the Social

Security Administration. That way, SSA will know what the check is for.

If the CBAS hearing penalty check is counted as income or a resource

under SSI, it will be considered income in the month you get it. In the

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9