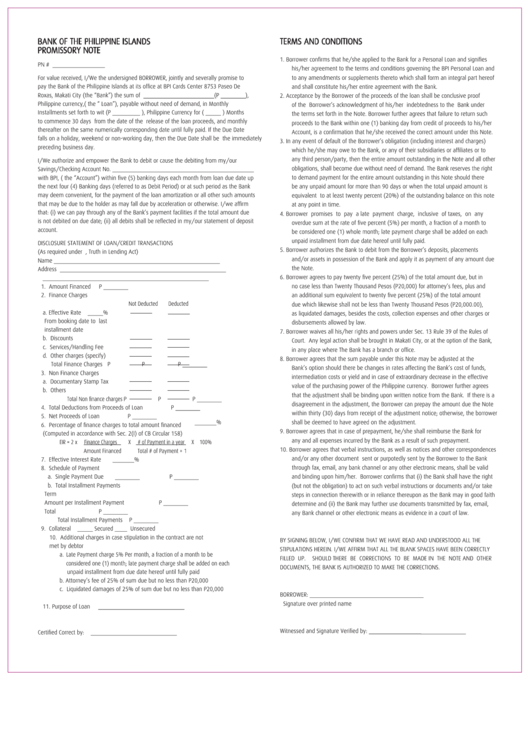

Bank Of The Philippine Islands Promissory Note

ADVERTISEMENT

BANK OF THE PHILIPPINE ISLANDS

TERMS AND CONDITIONS

PROMISSORY NOTE

1.

Borrower confirms that he/she applied to the Bank for a Personal Loan and signifies

PN # _________________

his/her agreement to the terms and conditions governing the BPI Personal Loan and

For value received, I/We the undersigned BORROWER, jointly and severally promise to

to any amendments or supplements thereto which shall form an integral part hereof

pay the Bank of the Philippine Islands at its office at BPI Cards Center 8753 Paseo De

and shall constitute his/her entire agreement with the Bank.

Roxas, Makati City (the “Bank”) the sum of _______________________(P ________),

2.

Acceptance by the Borrower of the proceeds of the loan shall be conclusive proof

Philippine currency,( the “ Loan”), payable without need of demand, in Monthly

of the Borrower’s acknowledgment of his/her indebtedness to the Bank under

Installments set forth to wit (P _________ ), Philippine Currency for ( _____ ) Months

the terms set forth in the Note. Borrower further agrees that failure to return such

to commence 30 days from the date of the release of the loan proceeds, and monthly

proceeds to the Bank within one (1) banking day from credit of proceeds to his/her

thereafter on the same numerically corresponding date until fully paid. If the Due Date

Account, is a confirmation that he/she received the correct amount under this Note.

falls on a holiday, weekend or non-working day, then the Due Date shall be the immediately

3.

In any event of default of the Borrower’s obligation (including interest and charges)

preceding business day.

which he/she may owe to the Bank, or any of their subsidiaries or affiliates or to

any third person/party, then the entire amount outstanding in the Note and all other

I/We authorize and empower the Bank to debit or cause the debiting from my/our

obligations, shall become due without need of demand. The Bank reserves the right

Savings/Checking Account No. ______________________________________________

with BPI, ( the “Account”) within five (5) banking days each month from loan due date up

to demand payment for the entire amount outstanding in this Note should there

the next four (4) Banking days (referred to as Debit Period) or at such period as the Bank

be any unpaid amount for more than 90 days or when the total unpaid amount is

may deem convenient, for the payment of the loan amortization or all other such amounts

equivalent to at least twenty percent (20%) of the outstanding balance on this note

that may be due to the holder as may fall due by acceleration or otherwise. I/we affirm

at any point in time.

that: (i) we can pay through any of the Bank’s payment facilities if the total amount due

4.

Borrower promises to pay a late payment charge, inclusive of taxes, on any

is not debited on due date; (ii) all debits shall be reflected in my/our statement of deposit

overdue sum at the rate of five percent (5%) per month, a fraction of a month to

account.

be considered one (1) whole month; late payment charge shall be added on each

unpaid installment from due date hereof until fully paid.

DISCLOSURE STATEMENT OF LOAN/CREDIT TRANSACTIONS

5.

Borrower authorizes the Bank to debit from the Borrower’s deposits, placements

(As required under R.A. 3765, Truth in Lending Act)

and/or assets in possession of the Bank and apply it as payment of any amount due

Name

______________________________________________________

the Note.

Address ______________________________________________________

6.

Borrower agrees to pay twenty five percent (25%) of the total amount due, but in

______________________________________________________

1. Amount Financed

P ________

no case less than Twenty Thousand Pesos (P20,000) for attorney’s fees, plus and

2. Finance Charges

an additional sum equivalent to twenty five percent (25%) of the total amount

Not Deducted

Deducted

due which likewise shall not be less than Twenty Thousand Pesos (P20,000.00),

a. Effective Rate

_____%

as liquidated damages, besides the costs, collection expenses and other charges or

From booking date to last

disbursements allowed by law.

installment date

7.

Borrower waives all his/her rights and powers under Sec. 13 Rule 39 of the Rules of

b. Discounts

Court. Any legal action shall be brought in Makati City, or at the option of the Bank,

c. Services/Handling Fee

in any place where The Bank has a branch or office.

d. Other charges (specify)

8.

Borrower agrees that the sum payable under this Note may be adjusted at the

Total Finance Charges P

P

P ________

Bank’s option should there be changes in rates affecting the Bank’s cost of funds,

3. Non Finance Charges

intermediation costs or yield and in case of extraordinary decrease in the effective

a. Documentary Stamp Tax

value of the purchasing power of the Philippine currency. Borrower further agrees

b. Others

that the adjustment shall be binding upon written notice from the Bank. If there is a

Total Non finance charges P

P

P ________

disagreement in the adjustment, the Borrower can prepay the amount due the Note

4. Total Deductions from Proceeds of Loan

P ________

within thirty (30) days from receipt of the adjustment notice; otherwise, the borrower

5. Net Proceeds of Loan

P ________

_______%

shall be deemed to have agreed on the adjustment.

6. Percentage of finance charges to total amount financed

9.

Borrower agrees that in case of prepayment, he/she shall reimburse the Bank for

(Computed in accordance with Sec. 2(I) of CB Circular 158)

any and all expenses incurred by the Bank as a result of such prepayment.

EIR = 2 x

Finance Charges

X

# of Payment in a year

X 100%

10. Borrower agrees that verbal instructions, as well as notices and other correspondences

Amount Financed

Total # of Payment + 1

and/or any other document sent or purpotedly sent by the Borrower to the Bank

7. Effective Interest Rate

_______%

through fax, email, any bank channel or any other electronic means, shall be valid

8. Schedule of Payment

a. Single Payment Due

________

P ________

and binding upon him/her. Borrower confirms that (i) the Bank shall have the right

b. Total Installment Payments

(but not the obligation) to act on such verbal instructions or documents and/or take

Term

steps in connection therewith or in reliance thereupon as the Bank may in good faith

Amount per Installment Payment

P ________

determine and (ii) the Bank may further use documents transmitted by fax, email,

Total

P ________

any Bank channel or other electronic means as evidence in a court of law.

Total Installment Payments

P ________

9. Collateral

_____ Secured ____ Unsecured

10. Additional charges in case stipulation in the contract are not

BY SIGNING BELOW, I/WE CONFIRM THAT WE HAVE READ AND UNDERSTOOD ALL THE

met by debtor

STIPULATIONS HEREIN. I/WE AFFIRM THAT ALL THE BLANK SPACES HAVE BEEN CORRECTLY

a. Late Payment charge 5% Per month, a fraction of a month to be

FILLED UP.

SHOULD THERE BE CORRECTIONS TO BE MADE IN THE NOTE AND OTHER

considered one (1) month; late payment charge shall be added on each

DOCUMENTS, THE BANK IS AUTHORIZED TO MAKE THE CORRECTIONS.

unpaid installment from due date hereof until fully paid

b. Attorney’s fee of 25% of sum due but no less than P20,000

c. Liquidated damages of 25% of sum due but no less than P20,000

BORROWER: _____________________________________

Signature over printed name

11. Purpose of Loan

____________________________

_____________

Witnessed and Signature Verified by: _________________

Certified Correct by:

____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Miscellaneous

1

1