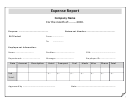

Expense Report Template Page 2

Download a blank fillable Expense Report Template in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Expense Report Template with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Reimbursement Policies

Reimbursement will be made for food consumed while on official business for the NCBA/NCBF. The

reimbursement is limited to three meals per day.

Alcoholic beverage consumption is a personal expense.

Snacks are personal expenses and will not be reimbursed unless they are substitutes for meals and documented

as such.

Reimbursement will be made for tips up to 20 percent of a bill. Tips in excess of 20 percent are personal

expenses.

Personal phone calls will not be reimbursed.

Receipts are required for taxis. When taxis are necessary, the receipts should list pickup and delivery points.

Reimbursement for personal entertainment will not be made. This includes movies, golf, tennis, recreational

vehicle rentals, walking tours, shows or any other such personal activity unless sponsored and pre-authorized

for reimbursed participation by the NCBA/NCBF as a group activity.

Receipts are required for all expenses for which reimbursement is requested. Recognizing that there are

times when obtaining a receipt is difficult and awkward, under special circumstances the NCBA/NCBF will

make reimbursement for an expenditure without a receipt, but documentation must include what was

purchased, why and an explanation of why the receipt is missing.

The IRS requires the additional following information for all meal expenditures of $25 or more:

C

The business purpose of the meal.

C

Date and location.

C

Names and positions of individuals entertained, if applicable.

Requests for reimbursement submitted without proper documentation will not be paid until the proper

documentation is presented.

When requesting reimbursement for air travel, you must submit the last portion of the ticket which is left after

completion of travel. Neither an itinerary nor a receipt for payment is sufficient. If the required portion of

the ticket is lost, proof of payment and a written explanation is required before reimbursement can be made.

(An Electronic Ticket itinerary is sufficient for Electronic Tickets.)

Requests for reimbursement will be submitted on an official NCBA/NCBF Expense Report as soon as practical,

but not later than 60 days following the expenditure. Expenses incurred in May and June must submitted for

reimbursement not later than July 15, in order to be accounted for in the proper fiscal year. Requests not made

in the time frames outlined in this paragraph will not be paid

.

Reimbursement for airline or hotel reservations will not be made until the actual trip has occurred

.

Please return to:

NC Bar Foundation

PO Box 3688

Cary, NC 27519-3688

or

919.677.1774 (fax)

Note: See reverse side for reimbursement policies

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2