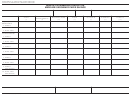

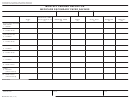

Medicare Secondary Payer Change Form Page 2

ADVERTISEMENT

Medicare Secondary Payer Definitions

“Current Employment Status” means when an individual (1) is actively working as an employee; (2) is the employer; (3) is associated with the em-

ployer in a business relationship (e.g., as a supplier or contractor who does business with the employer); (4) is not actively working but is receiving

disability benefits from an employer for up to six months; or (5) is not actively working but meets all of the following conditions: the individual (a)

retains employment rights in the industry; (b) has not had his/her employment terminated by the employer where the employer provides the cover-

age or has not had his/her membership in an employee organization terminated where the employee organization provides the coverage; (c) is not

receiving disability benefits from an employer for a period of more than six months; (d) is not receiving disability Social Security benefits, and (e) has

Group Health Plan coverage that is not pursuant to COBRA continuation benefits. 42 U.S.C. § 1395y(b)(1)(E)(ii); 42 C.F.R. § 411.104.

An employer employs “20 or More Employees” if the employer employed 20 or more employees for each working day in each of 20 or more cal-

endar weeks in the current or preceding calendar year. 42 C.F.R. § 411.170(a)(2)(i). The 20 calendar weeks do not have to be consecutive. COB

News, Vol. 5 (March 2004). (Please note that this test differs from the 20 employee test for COBRA purposes). In determining whether employees

are treated as employees of a single employer for purposes of the MSP rule, and whether leased employees are considered employees, the MSP

regulations look to Internal Revenue Code provisions and guidance (as evidenced in the “aggregation rules” set forth in regulation and the CMS MSP

Manual). See 42 C.F.R. § 411.106.

An employer (or employee organization) is considered to meet the “100 or more employees” requirement where the employer or employee organi-

zation employed at least 100 full-time or part-time employees on 50 percent or more of its regular business days during the previous calendar year.

This requirement is also met where a multi-employer group health plan has two or more employers, or employee organizations, at least one of which

employed at least 100 full-time or part-time employees on 50 percent or more of its regular business days during the previous calendar year. 42

C.F.R. § 411.101 (Definitions).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Medical

1

1 2

2