Instructions For 2010 Form 4a: Wisconsin Apportionment Data For Combined Groups

ADVERTISEMENT

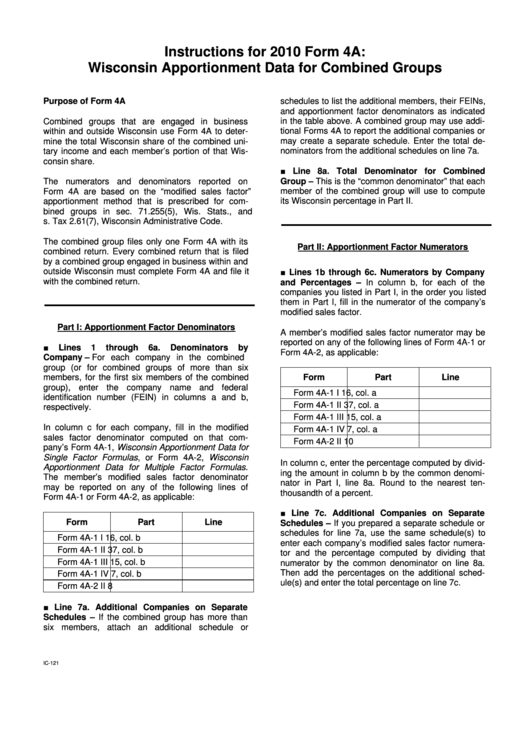

Instructions for 2010 Form 4A:

Wisconsin Apportionment Data for Combined Groups

schedules to list the additional members, their FEINs,

Purpose of Form 4A

and apportionment factor denominators as indicated

Combined groups that are engaged in business

in the table above. A combined group may use addi-

tional Forms 4A to report the additional companies or

within and outside Wisconsin use Form 4A to deter-

may create a separate schedule. Enter the total de-

mine the total Wisconsin share of the combined uni-

tary income and each member’s portion of that Wis-

nominators from the additional schedules on line 7a.

consin share.

■ Line 8a. Total Denominator for Combined

Group – This is the “common denominator” that each

The numerators and denominators reported on

member of the combined group will use to compute

Form 4A are based on the “modified sales factor”

its Wisconsin percentage in Part II.

apportionment method that is prescribed for com-

bined groups in sec. 71.255(5), Wis. Stats., and

s. Tax 2.61(7), Wisconsin Administrative Code.

The combined group files only one Form 4A with its

Part II: Apportionment Factor Numerators

combined return. Every combined return that is filed

by a combined group engaged in business within and

■ Lines 1b through 6c. Numerators by Company

outside Wisconsin must complete Form 4A and file it

with the combined return.

and Percentages – In column b, for each of the

companies you listed in Part I, in the order you listed

them in Part I, fill in the numerator of the company’s

modified sales factor.

Part I: Apportionment Factor Denominators

A member’s modified sales factor numerator may be

reported on any of the following lines of Form 4A-1 or

■

Lines

1

through

6a.

Denominators

by

Form 4A-2, as applicable:

Company – For each company in the combined

group (or for combined groups of more than six

members, for the first six members of the combined

Form

Part

Line

group), enter the company name and federal

Form 4A-1

I

16, col. a

identification number (FEIN) in columns a and b,

Form 4A-1

II

37, col. a

respectively.

Form 4A-1

III

15, col. a

In column c for each company, fill in the modified

Form 4A-1

IV

7, col. a

sales factor denominator computed on that com-

Form 4A-2

II

10

pany’s Form 4A-1, Wisconsin Apportionment Data for

Single Factor Formulas, or Form 4A-2, Wisconsin

In column c, enter the percentage computed by divid-

Apportionment Data for Multiple Factor Formulas.

ing the amount in column b by the common denomi-

The member’s modified sales factor denominator

nator in Part I, line 8a. Round to the nearest ten-

may be reported on any of the following lines of

thousandth of a percent.

Form 4A-1 or Form 4A-2, as applicable:

■ Line 7c. Additional Companies on Separate

Form

Part

Line

Schedules – If you prepared a separate schedule or

schedules for line 7a, use the same schedule(s) to

Form 4A-1

I

16, col. b

enter each company’s modified sales factor numera-

Form 4A-1

II

37, col. b

tor and the percentage computed by dividing that

Form 4A-1

III

15, col. b

numerator by the common denominator on line 8a.

Then add the percentages on the additional sched-

Form 4A-1

IV

7, col. b

ule(s) and enter the total percentage on line 7c.

Form 4A-2

II

8

■ Line 7a. Additional Companies on Separate

Schedules – If the combined group has more than

six members, attach an additional schedule or

IC-121

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2