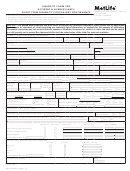

Short Term & Long Term Disability Income Protection Insurance Enrollment Form Page 2

ADVERTISEMENT

STD

LTD

Age Band*

.52

.28

< 25

.54

.31

25 – 29

.56

.33

30 – 34

.63

.43

35 – 39

.81

.56

40 – 44

.96

.74

45 – 49

1.12

1.07

50 – 54

1.51

1.27

55 – 59

1.93

1.39

60 – 64

2.21

1.56

65 – 69

2.21

2.20

70+

st

*Your age as of the next July 1

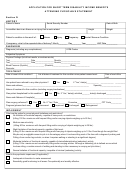

To calculate your per-paycheck cost for the STD coverage, complete the calculation below:

Annual Salary ________ 52 = Weekly Salary $________ x 60 % = $ ________ Weekly Benefit

Weekly Benefit $ ________ 10 = $_______ X Rate ______ = $ ________ Monthly Cost

Monthly Cost $ ________ X 12 = Annual Cost $_______ ____# of Paycycles = ________ Cost Per Pay Period**

To calculate your per-paycheck cost for the LTD coverage, complete the calculation below:

Annual Salary ________ 100 = ________ x ________ (Rate) = Your Annual Cost ($) ________

Your Annual Cost ($) ________ ________ (# of Paycycles per Year) = ($) ________ Cost Per Pay Period **

For example, if you were 45 years old, earned $45,000 annually, and were paid in 26 paycycles per year, your

calculation would be:

$45,000 (Annual Salary) 52 = 865.38 x 60% = $519.23 Your Weekly Benefit

STD:

$519.23 (Your Weekly Benefit) 10 = $51.92 X .96 (Rate) = $49.85 Monthly Cost

$49.85 (Monthly Cost) X 12 = $598.20 (Annual Cost) 26 (# of paycycles) = $23.01 per Pay Period**

$45,000 (Annual Salary) 100 = 450 x .74 (Rate) = $333.00 (Your Annual Cost)

LTD:

$333.00 26 (# of Paycycles Per Year) = $12.81 Per Pay Period**

** Final cost may vary slightly due to rounding differences. Your premium is based on your current salary and will increase as your

salary increases.

NS-6402 -2003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2