Form Cr-Ga - Green Acres Addendum Form

ADVERTISEMENT

CR-GA Add-08

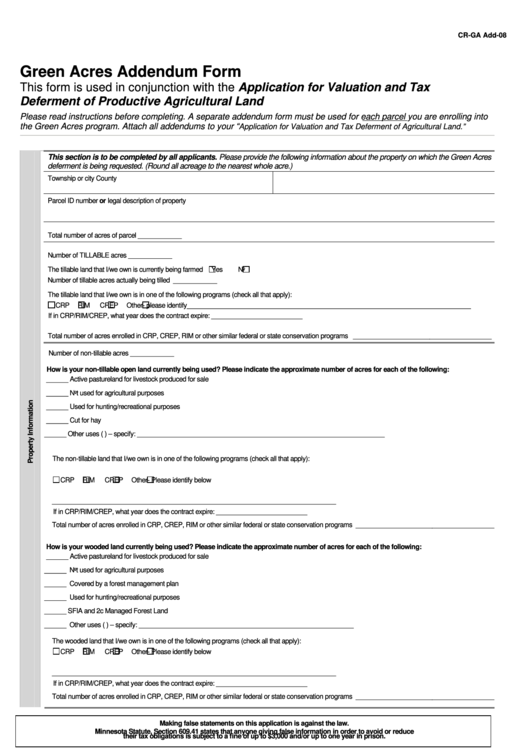

Green Acres Addendum Form

This form is used in conjunction with the Application for Valuation and Tax

Deferment of Productive Agricultural Land

Please read instructions before completing. A separate addendum form must be used for each parcel you are enrolling into

the Green Acres program. Attach all addendums to your “

Application for Valuation and Tax Deferment of Agricultural Land.”

This section is to be completed by all applicants. Please provide the following information about the property on which the Green Acres

deferment is being requested. (Round all acreage to the nearest whole acre.)

Township or city

County

Parcel ID number or legal description of property

Total number of acres of parcel ____________

Number of TILLABLE acres ____________

The tillable land that I/we own is currently being farmed

Yes

No

Number of tillable acres actually being tilled ____________

The tillable land that I/we own is in one of the following programs (check all that apply):

CRP

RIM

CREP

Other- please identify______________________________________________________________________________

If in CRP/RIM/CREP, what year does the contract expire: _________________________

Total number of acres enrolled in CRP, CREP, RIM or other similar federal or state conservation programs ______________________________________

Number of non-tillable acres ____________

How is your non-tillable open land currently being used? Please indicate the approximate number of acres for each of the following:

______ Active pastureland for livestock produced for sale

______ Not used for agricultural purposes

______ Used for hunting/recreational purposes

______ Cut for hay

______ Other uses (e.g. pasture for horses) – specify: ____________________________________________________________________

The non-tillable land that I/we own is in one of the following programs (check all that apply):

CRP

RIM

CREP

Other- Please identify below

______________________________________________________________________________

If in CRP/RIM/CREP, what year does the contract expire: _________________________

Total number of acres enrolled in CRP, CREP, RIM or other similar federal or state conservation programs ______________________________________

How is your wooded land currently being used? Please indicate the approximate number of acres for each of the following:

______ Active pastureland for livestock produced for sale

______ Not used for agricultural purposes

______ Covered by a forest management plan

______ Used for hunting/recreational purposes

______ SFIA and 2c Managed Forest Land

______ Other uses (e.g. pasture for horses) – specify: ___________________________________________________________

The wooded land that I/we own is in one of the following programs (check all that apply):

CRP

RIM

CREP

Other- Please identify below

______________________________________________________________________________

If in CRP/RIM/CREP, what year does the contract expire: _________________________

Total number of acres enrolled in CRP, CREP, RIM or other similar federal or state conservation programs ______________________________________

Making false statements on this application is against the law.

Minnesota Statute, Section 609.41 states that anyone giving false information in order to avoid or reduce

their tax obligations is subject to a fine of up to $3,000 and/or up to one year in prison.

Signature of an Owner: By signing below, I certify that the above information is true and correct to the best of my knowledge, and I am an owner of the property or

an authorized member, partner, or shareholder of the farm entity that owns the property for which Green Acres is being claimed. I acknowledge that by signing this

form I am representing 100 percent of the interest in the property.

Signature

Date

Revised 08/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2