Form No. 15h - Declaration Under Sub-Section (1c) Of Section 197a Of The Income-Tax Act, 1961, To Be Made By An Individual Who Is Of The Age Of Sixty-Five Years Or More Claiming Certain Receipts Without Deduction Of Tax

ADVERTISEMENT

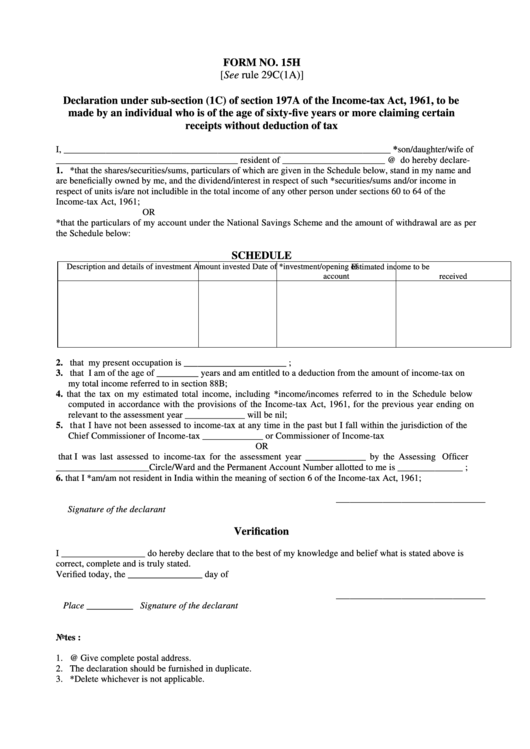

FORM NO. 15H

[See rule 29C(1A)]

Declaration under sub-section (1C) of section 197A of the Income-tax Act, 1961, to be

made by an individual who is of the age of sixty-five years or more claiming certain

receipts without deduction of tax

I, ______________________________________________________________________ *son/daughter/wife of

_______________________________________ resident of ______________________ @ do hereby declare-

1. *that the shares/securities/sums, particulars of which are given in the Schedule below, stand in my name and

are beneficially owned by me, and the dividend/interest in respect of such *securities/sums and/or income in

respect of units is/are not includible in the total income of any other person under sections 60 to 64 of the

Income-tax Act, 1961;

OR

*that the particulars of my account under the National Savings Scheme and the amount of withdrawal are as per

the Schedule below:

SCHEDULE

Description and details of investment

Amount invested

Date of *investment/opening of

Estimated income to be

account

received

2. that my present occupation is ______________________ ;

3. that I am of the age of _________ years and am entitled to a deduction from the amount of income-tax on

my total income referred to in section 88B;

4. that the tax on my estimated total income, including *income/incomes referred to in the Schedule below

computed in accordance with the provisions of the Income-tax Act, 1961, for the previous year ending on

relevant to the assessment year _____________ will be nil;

5. that I have not been assessed to income-tax at any time in the past but I fall within the jurisdiction of the

Chief Commissioner of Income-tax _____________ or Commissioner of Income-tax

OR

that I was last assessed to income-tax for the assessment year _____________ by the Assessing Officer

____________________Circle/Ward and the Permanent Account Number allotted to me is ______________ ;

6. that I *am/am not resident in India within the meaning of section 6 of the Income-tax Act, 1961;

________________________________

Signature of the declarant

Verification

I __________________ do hereby declare that to the best of my knowledge and belief what is stated above is

correct, complete and is truly stated.

Verified today, the ________________ day of

________________________________

Place __________

Signature of the declarant

Notes :

1. @ Give complete postal address.

2. The declaration should be furnished in duplicate.

3. *Delete whichever is not applicable.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2