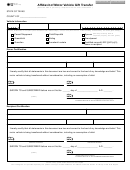

Form 14-317 (Back)(Rev.10-13/5)

Instructions for Filing Form 14-317, Affidavit of Motor Vehicle Gift Transfer

The purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by Texas Tax Code Section 152.062,

Required Statements.

What is a gift?

A gift is the transfer of a motor vehicle between eligible parties for no consideration. Consideration includes anything given as payment

such as cash, the assumption of a lien or other debt, payment for providing services or labor, or an exchange of real or tangible personal

property. A motor vehicle received as a gift from an eligible donor located out of state is subject to the $10 gift tax when the motor vehicle

is brought into Texas.

Eligible Gifts

To qualify for the $10 gift tax rate, a motor vehicle must be received from one of the following eligible parties:

• spouse (separate property only; vehicles held as community property are not subject to the tax);

• parent/stepparent; father/mother-in-law;

• grandparent/grandparent-in-law or grandchild/grandchild-in-law;

• child/stepchild; son/daughter-in-law;

• sibling/brother-in-law/sister-in-law;

• guardian;

• decedent’s estate (inherited/willed or through an Affidavit of Heirship for a Motor Vehicle);

• nonprofit service organization qualifying under Internal Revenue Code (IRC) Section 501(c)(3), (gift tax applies when the 501(c)(3)

organization is the donor or the recipient); or

• certain revocable (living) trusts, typically used in estate planning, described in Tax Code Section 152.025.

A motor vehicle transfer made without payment or consideration to an ineligible party is defined as a sale and subject to Standard Pre-

sumptive Value (SPV) procedures. See Texas Tax Code Section 152.0412, Standard Presumptive Value; Use By Tax Assessor-Collector,

and Rule 3.79, Standard Presumptive Value. A motor vehicle excluded from SPV is subject to tax based on its appraised value, as

provided by Rule 3.80, Motor Vehicles Transferred as a Gift or for No Consideration.

Who Must File

This affidavit must be submitted in person by either the donor or the recipient, with valid photo identification, to the county tax assessor-

collector (TAC). If the vehicle is received as part of an inheritance, either the recipient or the person authorized to act on behalf of the

estate (donor) must file the form in person with the TAC with valid photo identification, along with any documents required by the Texas

Department of Motor Vehicles (TxDMV) for titling purposes.

When and Where to File

This affidavit must be filed with the TAC of the county in which the Application for Texas Certificate of Title (Form 130-U) is submitted.

This affidavit must be accompanied by any required application fee, supporting documents, registration fee (if applicable) and any motor

vehicle tax due. Do not send the affidavit to the Comptroller of Public Accounts.

Documentation Required

To be valid, this affidavit must be properly completed and contain the signatures of all principal parties to the transaction, sworn to and

subscribed in front of one of these individuals:

• a notary public of Texas or the equivalent from another state or jurisdiction; or

• a TAC or an employee of the TAC, pursuant to Government Code Section 602.002.

The party or parties whose signature is being acknowledged by the TAC or an employee of the TAC must do the following:

• be present and sign the affidavit in front of the TAC or an employee of the TAC; or

• have a signed power of attorney from any absent party or the signature of the absent party, notarized by a notary public of Texas

or the equivalent from another state or jurisdiction. The absent party’s notarized signature may be reproduced (scanned or

printed) or faxed.

A motor vehicle title service may not file this affidavit.

If the gift transfer is the result of an inheritance, the executor should sign the gift affidavit as “donor.” Either the recipient (heir) or the

person authorized to act on behalf of the estate (donor) must file this affidavit in person with valid photo identification with the TAC,

along with any documents required by TxDMV for titling purposes (for example, letters testamentary, letters of administration or TxDMV

Form VTR-262, Affidavit of Heirship for a Motor Vehicle). If the transfer is completed using an Affidavit of Heirship for a Motor Vehicle,

only one heir is required to sign this affidavit as donor. When there are multiple donors or recipients signing, additional copies of this form

should be used to document signatures and notary acknowledgements.

Identification Required

The person filing this affidavit must present one of the forms of identification listed below to the TAC at the time of filing. The identifica-

tion provided must bear the name and photograph of the person filing the affidavit and must be unexpired.

The following forms of identification are acceptable:

• a driver’s license or personal identification card issued by this state or another state of the United States;

• an original passport issued by the United States or a foreign country;

• an identification card or similar form of identification issued by the Texas Department of Criminal Justice;

• a United States military identification card; or

• an identification card or document issued by the U.S. Department of Homeland Security or the U.S. Citizenship and Immigration

Services agency.

Questions

If you have questions or need more information, contact the Comptroller’s office at 1-800-252-1382 or 512-463-4600 or at

https:// Rule 3.80, Motor Vehicles Transferred as a Gift or for No Consideration, explains the law and

its provisions and is available on the Comptroller’s website at

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have

on file about you. Contact us at 1-800-252-1382 or 512-463-4600 or at https://

1

1 2

2