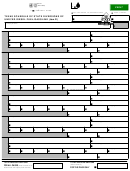

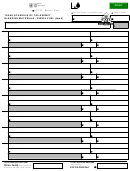

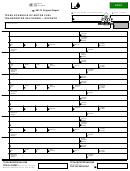

Form 06-134(Back)(Rev.9-03/2)

TEXAS SCHEDULE OF MOTOR FUEL TRANSPORTER DELIVERIES--EXPORTS

You have certain rights under Ch. 559, Government Code, to review, request, and correct information

we have on file about you. Contact us at the address or toll-free number listed on this form.

WHO MUST FILE

Every motor fuel transporter that transports gasoline or diesel fuel outside the bulk transfer/terminal system from Texas by truck,

railroad tank car, or marine vessel must file. Failure to file a required quarterly report may result in the assessment of civil penalty

as prescribed by Chapter 162 of the Tax Code.

FOR ASSISTANCE

For assistance with any Texas Fuels Tax questions, please contact the Texas State Comptroller's Office at 1-800-252-1383

toll-free nationwide, or call 512-463-4600. (From a Telecommunications Device for the Deaf (TDD) ONLY, call 1-800-248-4099

toll free, or call 512/463- 4621.)

GENERAL INSTRUCTIONS

Please write only in white areas.

TYPE or PRINT all information.

Complete all applicable items that are not preprinted.

If any preprinted information is not correct, mark out the incorrect item and write in the correct information.

ROUND ALL GALLONAGE FIGURES TO WHOLE GALLONS.

SPECIFIC INSTRUCTIONS

Item 1 - Enter the name of the seller.

Item 2 - Enter the taxpayer number or FEIN of the seller of the fuel.

Item 3 - Enter the name of the purchaser.

Item 4 - Enter the 11-digit taxpayer number of the purchaser of the fuel.

Item 5- Enter the three digit product type.

065 - Gasoline

228 - Dyed diesel fuel

072 - Dyed Kerosene

125 - Aviation gasoline

124 - Gasohol

160 - Clear diesel fuel

142 - Clear kerosene

130 - Jet fuel

Item 6- Enter a valid character for mode of transportation. Use one of the following:

J - Truck

R - Rail

B - Barge

Item 7 - Enter the 2-character standard state abbreviation of the state the fuel is destined for export. For example, AR for

Arkansas. If destination is outside the United States, enter 'ZZ'.

Item 8 - Enter the date, MM/DD/YY, as it appears on the Shipping Document/Bill of Lading. This is the date the fuel was

PHYSICALLY REMOVED from a terminal or bulk plant. May be left blank if summarizing transactions. See Item 9.

Item 9 - Enter the Shipping Document/Bill of Lading number. This is the identifying number from the document issued at the

terminal or bulk plant, when the product is removed. You may report the summary of multiple transactions when the

seller, the purchaser, the product type, the terminal control number or bulk plant location address in Item 10, and the

destination state are the same. Enter the word 'SUM.' You must maintain detailed records of transactions reported

as a summary.

Item 10 - Enter the terminal control number of the facility the fuel was removed. Enter the physical street address and city of the

bulk plant when the fuel is removed from a non-IRS registered bulk plant.

Item 12 - Enter invoiced gallons, rounding to the nearest whole gallon. You may report the summary of multiple transactions

when the seller, the purchaser, the product type, the terminal control number or bulk plant location address in Item 10,

and the destination state are the same. See Item 9.

1

1 2

2