Salon Worksheet Template Page 2

ADVERTISEMENT

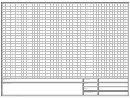

Business Expenses

Advertising

$

Office/ Furnishings

$

Business Cards

$

Decorative Items

$

Direct Mail

$

Interior Plants

$

News Paper/Magazine

$

Satellite Radio

$

Yellow Pages

$

CD’s

$

Misc. Advertising

$

Accounting and Bookkeeping fees

$

$

Legal/Professional Fees

$

Telephone Service/Usage

Answering Service

$

Appointment Book

$

Basic Phone Service (not home)

$

Palm Pilot (purchased this tax year)

$

Usage/Long Distance Expense

$

Educator Supplies

$

Cell Phone

$

Tipping Out Expenses

$

Pager

$

Postage & Shipping Expense

$

$

Copy & Printing Expenses

$

Telephone Equip. Purchased this tax year

Answering Machine

$

Photo & Camera Expenses

$

Telephone

$

Bank Charges

$

Cell phone

$

Professional Association Fees & Dues

$

Pager

$

Trade Publications

$

Liability Insurance

$

Client Publications/Magazines

$

Self Employed Health Insurance

$

Client Gifts

$

Rent

$

Client Cards (Birthday, Holiday etc)

$

Common Area Maintenance

$

Snack Items

$

Utilities (Non Home Office/Shop)

$

Coffee Supplies

$

Cleaning Services

$

Misc. Supplies

$

Internet Access Fees

$

Misc. Repairs

$

Entertainment Expense - If you have a bona fide and substantial discussion, regarding professional/business subjects, your “Entertainment Expense”

while conducting this business is deductible. You conducted business, i.e. discussed it, and the expenses of your activities associated with this

discussion are deductible. You must have a receipt with time, date, subject of discussion and persons present. Qualifying items may include, Golf

T’s, Gym (per visit expense), Movie, etc. as long as you had a bona fide discussion that professionally related to your business.

$

Continuing Education Seminar/Conference

Class Hours/Tuition Expense

$

Educational Material Expense

$

Seminar/Conference Fees

$

Online/Home Study Expense

$

Travel Expenses – Non Local - Conference, Conventions, out of town Assignments/Education (Non Reimbursed).

$

Hotel Expense – For above travel.

$

Meals – Conference, Conventions, out of town assignments non-reimbursed.

$

Vehicle Expense – Please answer ALL questions below!

Vehicle expenses (gas, repairs, insurance)

$

Is this evidence written?

Yes

or

No

Type & Year of Vehicle:

If you lease, what is the monthly payment?

$

Date First Used for Business:

/

/

Number of Miles Driven for Business

mi.

Do you have another car for personal use?

Yes or

No

Number of Miles Driven for Personal

mi.

Do you have evidence to support the deduction? Yes or No

Number of Miles Driven for Commuting

mi.

Home Office/Shop

Square Footage of Home

sq./ft

Cost of Utilities per Month

$

Square Footage of Space/Room Used

sq./ft

Amount of Rent Paid per Month

$

Purchase Price of Home

$

Insurance – Homeowners/Renters

$

Number of Months Office was in Home

Other - Specify

$

Comments and Other Expenses:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2