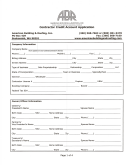

Target Credit Account Application Page 2

Download a blank fillable Target Credit Account Application in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Target Credit Account Application with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

SAFETYNET SUMMARY OF PROTECTIONS, continued

Hospitalization and Nursing Home Care Benefits: Following fourteen consecutive days of hospital-

Cost of Protection: The fee rate for the SafetyNet program is 99¢ per $100 of the protected balance

ization or nursing home care, SafetyNet will cancel the amount of the purchase balance on your

on your Account each month (including any deferred balance). The fee rate is subject to change.

Account on the date you or your joint Accountholder were admitted to the hospital or nursing home.

This information is accurate as of October 1, 2007.

During the fourteen days, the Accountholder that is hospitalized or receiving nursing home care must

Additional Important Disclosures:

be confined to the hospital or nursing home and must be under the continuous care of a physician.

•Target National Bank reserves the right to modify the terms and conditions of the SafetyNet pro-

Hospitalization or nursing home care that begins within ninety days of enrollment in SafetyNet is

gram. We will make any changes in accordance with the law.

not protected.

• The SafetyNet protections are offered only as a package and are not available separately.

Loss of Life Benefits: If you or your joint Accountholder dies, SafetyNet will cancel the amount of

the purchase balance on your Account on the date of death.

• SafetyNet benefits may be taxable as income if provided by law.

Maximum Cancellation: SafetyNet offers a maximum Account balance cancellation of $10,000 for

• SafetyNet benefits do not cover charges incurred on your Account after the effective date of the

any single protected event. If you experience one or more protected event(s) over the life of your

protected event (unless those charges are covered due to a subsequent protected event while you

Account, and the combined total of your paid SafetyNet claim(s) is $10,000 or more, we will cancel

continue to have SafetyNet protection).

your enrollment in SafetyNet after we pay the claim that brought the combined claim(s) total to

• During a claim qualification period and while your claim is being processed, your existing balance

$10,000 or more. SafetyNet does not apply to cash advance, balance transfer or convenience check

is not suspended or cancelled. You continue to be responsible for minimum payment requirements

balances, so the cancelled balance amount will not include advances, charges and fees associated

on your Account until the balance is paid off or cancelled.

with those features.

• SafetyNet does not cancel your balance if the protected event occurred before your enrollment in

Termination of Protection: You may terminate your SafetyNet protection at any time. If you choose

SafetyNet.

to terminate your SafetyNet protection within thirty days of enrollment, we will credit to your

• Unless you terminate your SafetyNet coverage after a protected event, the monthly fee will

Account any fee you have been charged. We can terminate your SafetyNet protection by giving you

continue to apply when you have an Account balance to protect any existing balance during the

written notice at least thirty days in advance of the termination (or as provided by law). Your

qualification period and to protect new charges in the event of a subsequent protected event.

SafetyNet coverage will be suspended automatically if your Account becomes more than ninety days

Questions About SafetyNet: Call Credit Services at 1-888-316-6151 with any questions you have

past due.

about the SafetyNet program.

Important Rate, Fee and Other Cost Information

Rates, fees and other terms may be changed at any time in accordance with the Credit Card Agreement and applicable law.

Target Visa Credit Card

Target Credit Card

12.74%

15.74%

18.74%

21.74%

23.74%

Annual Percentage Rate

,

,

or

(APR) for purchases

Based on credit qualification

Other APRs

Cash Advance APR 24.74%

Penalty APR: 27.74%

Penalty APR: 27.74% (see explanation below*)

(see explanation below*)

Variable Rate

Your APRs may vary.

Your APRs may vary.

Information

Purchase APR: Prime Rate** plus a margin of either

Purchase APR: Prime

4.99%, 7.99%, 10.99%, or13.99% depending on credit qualification.

Rate** plus 15.99%

Cash Advance APR: Prime Rate plus 16.99%

Penalty APR: Prime Rate

Penalty APR: Prime Rate plus 19.99%

plus 19.99%

Grace period for repayment

Not less than 25 days

of balances for purchases

Method of computing the

Average daily balance (including new purchases)

balance for purchases

Annual fees

None

Minimum finance charge

$1

Transaction fee for

International Service Assessment Fee of 3% of the amount

Not applicable

International Purchases

of each foreign currency transaction made outside the U.S.

and Cash Advances

(excluding Puerto Rico and the U.S. Virgin Islands)

Transaction fee for

3% ($5 minimum, no maximum)

Not applicable

cash advances

Late payment fee

$15 on balances $150 or less;

$29 on balances greater than $150 but less than $1,000;

$35 on balances of $1,000 or more, or if the account is subject to the

Penalty APR (see explanation below*)

* Applies if two times in any 12-month period we do not receive at least the Minimum Payment Due by the Payment Due Date, or if at any time all or a portion of two Minimum Payments Due are late.

**The Prime Rate used to determine your APRs is the highest Prime Rate published in the “Money Rates”section of The Wall Street Journal on the last business day of the previous month. Variable rates are cur-

rent for billing cycles ending in October, 2007. If the Prime Rate has changed, your APRs may be different than those disclosed above.

Additional Credit Information: The information about the credit terms of the Target Visa and the Target Card was accurate as of April 1, 2007 and is subject to change.

To find out what information may have changed, please write to Target National Bank, 3901 W. 53rd Street, Sioux Falls, SD 57106-4216.

Notice to New York Residents: A consumer credit report may be ordered in connection with this application, or subsequently with the update, renewal or extension of credit. Upon your request, you will be informed

of whether or not a consumer credit report was ordered, and if it was, you will be given the name and address of the consumer reporting agency that furnished the report.

Notice to Ohio Residents: The Ohio Laws against discrimination require that all creditors make credit equally available to all credit-worthy customers, and that credit reporting agencies maintain separate credit

histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with this law.

Notice to Rhode Island and Vermont Residents: A consumer credit report may be ordered in connection with this application, or subsequently for purposes of review or collection of the account, increasing the

credit line on the account, or other legitimate purposes associated with the account.

Notice to Married Wisconsin Residents: No provision of any marital property agreement, unilateral statement under Section 766.59 of the Wisconsin statutes or court order under Section 766.70, adversely affects

the interest of the creditor, Target National Bank, unless the Bank, prior to the time of the credit is granted or an open-end credit plan is entered into, is furnished a copy of the Agreement, Statement or Decree, or

has actual knowledge of the adverse provision. IF I AM A MARRIED RESIDENT, CREDIT EXTENDED UNDER THIS ACCOUNT WILL BE INCURRED IN THE INTEREST OF MY MARRIAGE OR FAMILY. Married applicants must

provide their Social Security number and address and their spouse’s name and address to Target Financial Services, PO Box 673, Minneapolis, MN 55440.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2