Application For At Will Employment Page 8

ADVERTISEMENT

2

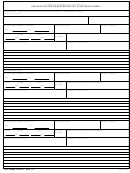

Form 8850 (Rev. 10-02)

Page

For Employer’s Use Only

(

)

-

Employer’s name

Telephone no.

EIN

Street address

City or town, state, and ZIP code

(

)

-

Person to contact, if different from above

Telephone no.

Street address

City or town, state, and ZIP code

If, based on the individual’s age and home address, he or she is a member of group 4 or 6 (as described under Members

of Targeted Groups in the separate instructions), enter that group number (4 or 6)

Was

Date applicant:

Gave

offered

Was

Started

information

/

/

job

/

/

hired

/

/

job

/

/

Under penalties of perjury, I declare that I completed this form on or before the day a job was offered to the applicant and that the information I have furnished is, to

the best of my knowledge, true, correct, and complete. Based on the information the job applicant furnished on page 1, I believe the individual is a member of a

targeted group or a long-term family assistance recipient. I hereby request a certification that the individual is a member of a targeted group or a long-term family

assistance recipient.

/

/

Employer’s signature

Title

Date

Privacy Act and

for administration of the Internal

The time needed to complete and file

Revenue laws, to the Department of

this form will vary depending on

Paperwork Reduction

Justice for civil and criminal litigation, to

individual circumstances. The estimated

Act Notice

the Department of Labor for oversight of

average time is:

the certifications performed by the

Recordkeeping

2 hr., 46 min.

Section references are to the Inter nal

SESA, and to cities, states, and the

Learning about the law

Revenue Code.

District of Columbia for use in

or the form

36 min.

Section 51(d)(12) permits a prospective

administering their tax laws. In addition,

Preparing and sending this form

employer to request the applicant to

we may disclose this information to

to the SESA

36 min.

complete this form and give it to the

Federal, state, or local agencies that

If you have comments concerning the

prospective employer. The information

investigate or respond to acts or threats

accuracy of these time estimates or

will be used by the employer to

of terrorism or participate in intelligence

suggestions for making this form

complete the employer’s Federal tax

or counterintelligence activities

simpler, we would be happy to hear from

return. Completion of this form is

concerning terrorism.

you. You can write to the Tax Forms

voluntary and may assist members of

You are not required to provide the

Committee, Western Area Distribution

targeted groups and long-term family

information requested on a form that is

Center, Rancho Cordova, CA

assistance recipients in securing

subject to the Paperwork Reduction Act

95743-0001.

employment. Routine uses of this form

unless the form displays a valid OMB

include giving it to the state employment

Do not send this form to this address.

control number. Books or records

security agency (SESA), which will

Instead, see When and Where To File in

relating to a form or its instructions must

contact appropriate sources to confirm

the separate instructions.

be retained as long as their contents

that the applicant is a member of a

may become material in the

targeted group or a long-term family

administration of any Internal Revenue

assistance recipient. This form may also

law. Generally, tax returns and return

be given to the Internal Revenue Service

information are confidential, as required

by section 6103.

8850

Form

(Rev. 10-02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8