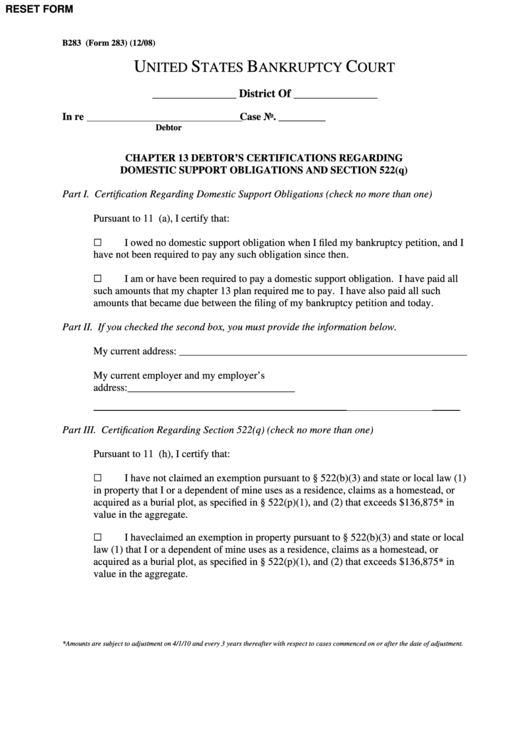

RESET FORM

B283 (Form 283) (12/08)

U

S

B

C

NITED

TATES

ANKRUPTCY

OURT

_______________ District Of _______________

In re

Case No. _________

Debtor

CHAPTER 13 DEBTOR’S CERTIFICATIONS REGARDING

DOMESTIC SUPPORT OBLIGATIONS AND SECTION 522(q)

Part I. Certification Regarding Domestic Support Obligations (check no more than one)

Pursuant to 11 U.S.C. Section 1328(a), I certify that:

G

I owed no domestic support obligation when I filed my bankruptcy petition, and I

have not been required to pay any such obligation since then.

G

I am or have been required to pay a domestic support obligation. I have paid all

such amounts that my chapter 13 plan required me to pay. I have also paid all such

amounts that became due between the filing of my bankruptcy petition and today.

Part II. If you checked the second box, you must provide the information below.

My current address: _______________________________________________________

My current employer and my employer’s

address:________________________________

_________________________________________________________________

_______

Part III. Certification Regarding Section 522(q) (check no more than one)

Pursuant to 11 U.S.C. Section 1328(h), I certify that:

G

I have not claimed an exemption pursuant to § 522(b)(3) and state or local law (1)

in property that I or a dependent of mine uses as a residence, claims as a homestead, or

acquired as a burial plot, as specified in § 522(p)(1), and (2) that exceeds $136,875* in

value in the aggregate.

G

I have claimed an exemption in property pursuant to § 522(b)(3) and state or local

law (1) that I or a dependent of mine uses as a residence, claims as a homestead, or

acquired as a burial plot, as specified in § 522(p)(1), and (2) that exceeds $136,875* in

value in the aggregate.

*Amounts are subject to adjustment on 4/1/10 and every 3 years thereafter with respect to cases commenced on or after the date of adjustment.

1

1 2

2