IOWA USE TAX EXEMPTIONS

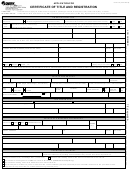

Owner Name_________________________________________________VIN________________________________________________________

If claiming an exemption from payment of Iowa Use Tax, check the appropriate box below and complete any required additional information. Any

applicable exemption code must be listed on page 1 of the title application form.

UT01 – Transfer by gift, please explain:

UT02 – Purchaser is one of the following non-profit or government organizations:

a. Rehabilitation Facility.

b. Rehabilitation Facility for Mentally Retarded Children.

c. Care Facility (residential/intermediate for the Mentally Retarded).

d. Care Facility (residential) for the Mentally ill.

e. Educational Institution (Private, non-profit).

f. Free-standing Hospice Facility.

g. Government.

h. Hospital licensed under Iowa Code Chapter 135B.

i. Community Healthy Center.

j. Migrant Health Center.

k. Community Mental Health Center.

l. Legal Aid Organization.

m. Non-profit Private Museum.

n. Non-profit Art Center.

o. Non-profit Organ Procurement Organization.

UT03

a. Vehicle transferred from a sole proprietorship or partnership to a corporation or LLC (or vice versa) with the ownership remaining exactly the

same and for the purpose of continuing the same business.

b. Corporate Merger – vehicle transferred pursuant to statute to the surviving corporation for no consideration, the merging corporation being

dissolved the moment the merger occurs and receiving no benefit from the merger.

Termination date of prior business:

Date of creation of new entity:

UT04 - Purchased by a licensed dealership for resale. Dealer License #:

UT05 - Purchased for rental. Purchaser’s sales tax permit #:

UT06 - Leased vehicle used solely in interstate commerce.

UT07 – Vehicle registered and/or operated under Iowa Code Section 326 (reciprocity) with gross weight of 13 tons or more and with 25% of the

mileage outside of Iowa. Both weight and mileage must be met to be eligible for exemption.

UT08 - Other:

a. Manufactured housing or mobile Home.

b. Inheritance or court order (e.g.: divorce).

c. Vehicle Purchased outside Iowa with no intent to use in Iowa. (A “move-in”)

d. Homemade vehicle.

e. Sales, Use, or Occupational tax paid to another state at time of purchase.

f. Name dropped.

g. Name added.

h. Even trade or down trade.

i. Delivered to a resident Native American Indian on the reservation.

j. In-Transit title, tax to be paid in title-holder’s state of residence.

k. Transfer to or from a living or irrevocable trust.

l. Other, please explain_________________________________

s. Salvage vehicle.

THE FOLLOWING TO BE COMPLETED IF THE VEHICLE DESCRIBED ON PAGE ONE IS A SPECIALLY CONSTRUCTED OR RECONSTRUCTED

MOTOR VEHICLE.

I have inspected the vehicle described upon the reverse side and have determined that the integral component parts are properly identified and that the rightful ownership has

been established.

Weight of vehicle_____________________________ Value of vehicle_____________________________ Annual Fee_____________________________

________________________

______________________________________________________

Date

Investigator

Iowa Department of Transportation

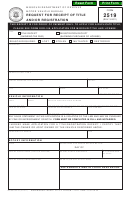

REGISTRATION FEE AND/OR FEE CREDIT CALCULATIONS

Current Year

*Next Year

1.

Full year registration fee of vehicle purchased

$____________

$_____________

2.

Remaining unexpired months – prorated percentage

_____________%

100%

3.

= New fee (Prorated)

$____________

$_____________

(minimum $5)

4.

Full year registration fee of vehicle

$____________

$_____________

sold, traded, or junked

5.

Remaining unexpired months – prorated percentage

_____________%

100%

6.

= Credit (Unused fee)

$____________

$_____________

None if less than $10

7.

Fee due (Line 3 minus Line 6)

$______________

$_____________

8.

Fee due if 14-month registration

$_____________

(add amounts on Line 7)

*

Use this column if two months remain and buyer opts to register for an additional year or if buyer paid annual fee on trade-in the month before renewal and traded

the same month (17% for current year and 100% for next year)

1

1 2

2