Form F-01189 - Wisconsin Chronic Renal Disease Financial Need Statement - 2016 Page 4

ADVERTISEMENT

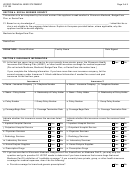

WCRDP FINANCIAL NEED STATEMENT

Page 4 of 5

F-01189

b. Provide reasonable access to retail providers and optionally for mail order coverage?

Yes

No

c. Pay on average at least 60 percent of your prescription drug expenses?

Yes

No

d. Satisfy at least one of the following criteria below:

Yes

No

1. The prescription drug coverage has no annual maximum benefit or a maximum annual

benefit payable by the plan of at least $25,000,

2. The prescription drug coverage has an actuarial expectation that the amount payable by the

plan will be at least $2,000 per Medicare eligible, or

3. For plans that have integrated supplemental coverage directly through a specific Part D plan,

the integrated health plan has no more than a $250 deductible per year, has no annual

benefit maximum payable by the plan of at least $25,000, and has not less than a

$1,000,000 lifetime combined benefit maximum?

SECTION 6. FINANCIAL INFORMATION

24. Indicate the number of dependent family members; include yourself if you are a dependent family member.

25. Indicate your current total income by completing items a.

Month

Year

Year

through m. either by monthly OR annual totals.

Average Monthly Totals

Annual Totals

$

$

a. Gross wages, salaries, tips, etc.

$

$

b. Net income from non-farm self-employment

$

$

c. Net income from farm self-employment

$

$

d. Social Security and/or Supplemental Security benefits

$

$

e. Dividends and interest income

$

$

f. Total of estate or trust income, net rental income, and royalties

$

$

g. Cash public benefits (e.g., W-2 payments)

$

$

h. Pensions, annuities, and/or Veterans Pension

$

$

i. Unemployment compensation and/or worker’s compensation

$

$

j. Maintenance, alimony, and/or child support

$

$

k. Nontaxable interest (federal, state, or municipal bonds)

$

$

l. Nontaxable deferred compensation

$

$

m. Total Monthly OR Yearly income

26. Do you expect this income to change significantly from month to month or in the next year?

Yes

No

27. If yes, will your income be less or more than the total above?

Yes

No

Explain why.

28. On last year’s Wisconsin Income Tax return, what was your total gross family income

$

before taxes?

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5