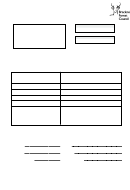

Solihull Metropolitan Borough Council Application For Small Business Rate Relief Page 2

ADVERTISEMENT

Solihull Metropolitan Borough Council

Application for Small Business Rate Relief

(

Before completing, please read the notes on the reverse of this form).

1.

Name of business or

organisation

Address of business or

organisation

2. If the business is not Limited please provide:

the name of the sole trader

or partner(s)

the address of the sole

trader or partner(s)

.

3

Is the business a Limited company

registered with Companies House?

Yes

No

4. Please supply the address of

the property for which Relief

is being claimed

5. Please supply the Solihull MBC Bill Account Number for the above property

6. Please supply the address(es)

of additional properties within

England or Wales which you

own or use for Non-Domestic

purposes

(continue on a separate sheet if necessary)

Declaration

I understand that knowingly making a false statement on my application is a criminal offence which could result

in up to three months imprisonment or a scale 3 fine or both.

I declare that the information I have provided is complete and accurate to the best of my knowledge.

I will notify the Council in writing (within 4 weeks) if there are any changes which may affect my entitlement to

this Relief.

/

/

Signature

Date

Capacity in which signed

Your daytime phone number

Your email address

You do not have to tell us your phone number or email address but it may help us to deal with your application more quickly.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2